Who’s bearing the tax burden?

One of the main underlying themes in today’s political calculus is that Americans are overtaxed. This meme persists despite plenty of reports to the contrary, at least on the federal level.

One of the main underlying themes in today’s political calculus is that Americans are overtaxed. This meme persists despite plenty of reports to the contrary, at least on the federal level.

We’re actually paying less in federal taxes as a percentage of income than we have in some time.

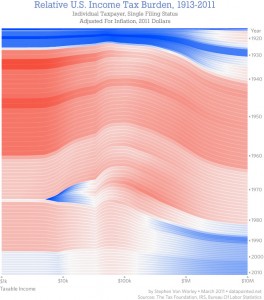

Still, most American say they’re paying too much taxes. This very nifty graph (H/T @fivethirtyeight) may explain why.

The Reagan era lowered the tax burden of wealthy Americans tremendously. The G.W. Bush era dropped most everyone else at least down to historic averages.

Two things stick out to me. 1) Almost no one is dramatically overburdened in paying federal taxes, according to these figures. 2) If anyone, it’s the middle class that’s being leaned on. That’s the conclusion the graph’s author comes to:

The people at our economy’s core – the full-time workers earning between $20,000 and $150,000 a year – still pay at up to double the rate of the ultra-wealthy, relative to what history suggests they should.

As tax time approaches, how are you feeling? Do you buy the argument this guy makes?

What is happening historically to other taxes?

Property tax, gas tax, fees that we pay that are actually taxes, etc.?

This is all happening in a back drop where we all have considerable less spending power since wages have not kept pace with rising costs.

Brian we can’t just look at income tax rates in a vacuum.

According to the graph:

“We adjusted everything for inflation to ensure an apples-to-apples comparison, with the caveat that the effects of Social Security, Medicare, and other taxes are not included. ”

With that caveat I think the data is pretty useless.

The problem with the income tax system is that it has morphed into a vehicle for social tinkering. Witness the advent of the refundable tax credit which is nothing more than a wealth transfer scam. The system has become so perverted that it should be scrapped in favor of a flat tax or a national sales tax thet would replace, not supplement, the income tax.

have to agree with Paul, 1:46PM I’m just going from memory which may be off a bit but back around 1990 the upper income limit on which SS taxes were subject to was aprox $48000. The same limit on Medicare was also in place but was changed in the mid 90’s to eliminate the upper threshold. (So Warren Buffet would now pay based on his total income not just the first $48000 or whatever the yearly limit was) Anyway amount of income subject to SS tax has increased almost every year since 1990 and the amount subject to the tax is now around $106,000. So for your average worker the amount of his tax bite is much bigger proportionatley than the high earners. Not fair at all. I think a means test of some sort is long overdue. ( I do realize that W Buffet would collect no more in SS than the guy hypothetically earning $106000. but I still think the system as is needs fixing)

Brian – this is an interesting question. One possible answer is that people’s incomes havent gone up in the last 20 years, but health care costs have gone way up. We’ve also had 30 years of a very public PR campaign to argue that if only we lowered taxes even more, peoples incomes could go up again. There also seems to be a “moral hazard” component to it. That is, a small amount of the tax money goes to poor people and NPR etc, and this causes them to become morally weakened. As long as we can afford to give these undeserving groups money, we are taxed at too high a rate.

It used to be axiomatic that America was the land of opportunity. Anyone born anywhere had the POTENTIAL of becoming rich in one generation.

Now, it’s graphs like this that destroy that dream. If you make $50,000, you get taxed. If you make $250,000 you get whammed. If you make $25,000,000 you get robbed, but who cares!, you are too rich and you need to be robbed.

Hence, there is no incentive to succeed. Society wants to punish your success.

A flat tax is the only FAIR tax.

Whoops – its David not Brian

“It used to be axiomatic that America was the land of opportunity. Anyone born anywhere had the POTENTIAL of becoming rich in one generation.”

What exact time period in our history are you referring to? Give us a date range.

It didn’t take this guy too long to get rich:

http://en.wikipedia.org/wiki/Mark_Zuckerberg

people have been getting rich lately – thats not the problem. Its the middle class thats suffering. Peter Hahn

From Tax Foundation:As the data below show, incomes reported by tax returns at the high end of the income spectrum plummeted from 2007 to 2008, as did their share of the nation’s income and income taxes paid. In 2008, the top 1 percent of tax returns paid 38.0 percent of all federal individual income taxes and earned 20.0 percent of adjusted gross income, compared to 2007 when those figures were 40.4 percent and 22.8 percent, respectively. Both of those figures—share of income and share of taxes paid—were their lowest since 2004 when the top 1 percent earned 19 percent of adjusted gross income (AGI) and paid 36.9 percent of federal individual income taxes.

Each year from 2005 to 2007, the top 1 percent’s constantly growing share of income earned and taxes paid set a record. That trend reversed in 2008. In fact, the income share for the top 1 percent of tax returns was lower in 2008 than in 2000, largely due to differences in capital gains.

Is it fair that the top 1% paid 38% of federal taxes while earning just 20% of the wages?

There have been people getting massively wealthy the past 20 years, at higher rates than in previous periods. Take NYS; we have a high average income but we have more poor people than other states and the bottom 20% in NYS do worse than states which have lower average incomes. We have a huge amount of very wealthy people and high rates of income inequality.

If we just think about our tax bill though, the federal income tax is only one part of that bill. In many states including NY you must look at Property Tax, Sales Tax, Social Security Taxes/Medicaid-Medicare, State Income Tax Federal Income Tax, capital gains taxes, corporate taxes and inheritance taxes. Certainly the Federal income tax is a large part of those but you really miss the picture of taxation in the US if we only look at the federal income tax.

It is an interesting graph though and I think it shows that the income tax is not too high that is for sure.

Peter I agree. People getting richer, middle class, poor and Zuckerberg is the answer to our economic problems.

Mervel – also unless you make well over 100K, the income tax is a tiny portion of your tax – even federal tax. Most is payroll tax – medicare and social security – which act as a flat tax. For those making 50K/year or less, the federal income tax itself is probably zero. Peter Hahn

phahn “What exact time period in our history are you referring to? Give us a date range.” pre-Obama :)

The top 50% of wage earners pay 96% of our taxes. Not good.

Flat tax. Good.

Clearly, the richest corporations, which give us neat stuff like Japanese nuclear reactors and PCBs, are overtaxed:

http://abcnews.go.com/Politics/general-electric-paid-federal-taxes-2010/story?id=13224558

What happens to me is that I am not around wealthy people very much. The well off people here are teachers, professors and corrections officers etc. I don’t know any software, banking or hedge fund style wealthy people, they seem like ghosts at least in St. Lawrence County. I don’t count doctors because up here I think they earn every penny.

But go down to Greenwich or New Cannan etc. and look at what real wealth is we don’t see that up here so these taxes might seem high and unfair to us or these taxes seem like they are driving out wealth, but the fact of the matter is these people have so much wealth that these taxes are very low for them.

The very rich are not moving out of these places and going to Texas. However the middle class IS doing that as Texas and the Midwest are better places for low and middle class earners not the super wealthy. They are doing fine right here in New York.

Mervel is right. The very wealthy are doing just fine. By the way most doctors aren’t really all that wealthy. Very few of them have seven, eight, or nine figure earnings every year.

People keep telling us that we can’t tax the wealthy because they are the ones who create all the jobs. Well Bush cut their taxes and Obama continued the cuts and Cuomo is in on it too and yet I just don’t see all the jobs being created. Maybe somebody isn’t telling me the truth?

Paul, the example of Zuckerberg is instructive– the kid was at Harvard. His parents are a psychiatrist and a dentist. Show me a kid, other than an athlete or an entertainer, who went to one of those schools that we’re going to cut education spending at, who made it big in one generation.

And what about those Wall Street geniuses who brought us the mess we’re in now. You really think they deserve to keep their multi-million dollar salaries and bonuses so they have an incentive to keep coming up with more brilliant ways to scam investors? How about rewards for those intrepid CEO’s who boldly outsource jobs once done by American workers so that they can push their company’s stock price ever higher, thus “justifying” their outsized salaries? Wouldn’t want to disincentivise that kind of behavior, now would we?

A lot of these folks, if we could drive them from our shores we’d be a whole lot better off, if you ask me.

One other thing to remember is that along with the tax cutting Americans were encouraged to buy on credit so while taxes may be low relative to income historically speaking, the portion of income committed to repaying credit is higher than in the 50s or 60s. Consequently the threat of increased taxes is likely to hurt more than if we all lived at the earlier lifestyle.

KHL, Jobs are created when an employer needs more workers, not just because they have extra money lying around. Capitalism is not that altruistic. Corporations currently have many billions in space cash but are waiting for demand to pick up. Ironically consumers are waiting for the job market to pick up out of fear that they might be the next to get a pink slip. SO we all stand around waiting for each other to do something.

As someone mentioned, “Flat Tax”. I keep hearing that a flat tax would increase my (lower middle class) tax burden. I doubt this is true. The one key to a flat tax working is that everyone would have to pay. There would be no such thing as a loophole. You can change the rate at which so called rich people are taxed all you want but it will probably do little to generate extra revenue because there are so many available loopholes.

A flat tax would also eliminate the need for much of what the IRS currently does. The IRS would only be needed to help set the tax rates and to collect the taxes. There would be no need for tax returns and all of the government employees that deal with them. This alone could help lower our taxes. I realize that this would be harmful to a lot of CPAs and lawyers who specialize in tax preparation or evasion (in some cases). But, like Andrew Cuomo said about prisons: A taxation program is not a jobs creation program.

We also need to trim government back to a reasonable level. Government is not efficient no matter how well intentioned the agencies, workers, or original legislation that established them are. Government breeds inefficiency. If you have ever worked for a government agency then you know what I am talking about. If you have never worked for a government agency then you also know what I am talking about.

Walker, We won’t have to drive these people from our shores. They’ll move into their gated communities, buy a vacation resort in the Cayman Islands, move their wealth to a foreign bank, and one day, when they get tired of seeing people sleeping on the sidewalk…they just won’t come back.

Tax them to death before they go.

The point of my question was that JDM is waxing poetic about an economic period in our past, while at the same time suggesting that a flat tax is the answer to the current economic situation.

A quick exercise to check the consistency of his argument is to examine the period of time JDM is referring to and see what sort of tax system was in place. Was it a flat tax? My guess is no.

If we paused the capital gains tax two years, this economy would take off like a blow torch.

The rich would get richer, the poor would get richer, and those in the middle would get richer.

Ugh! Capital gains is only taxed at 15% as it is so any wealthy person with a lawyer and an accountant manages to get most of their “income” taxed at 15%.

I wish all of my income was only taxed at 15%.

The rich don’t need help to spur the economy, the poor and middle-class do.

What we need to do is provide single-payer national health care. That would be a many thousand dollar incentive for people to create their own small businesses.

Walker- “Show me a kid, other than an athlete or an entertainer, who went to one of those schools that we’re going to cut education spending at, who made it big in one generation.”

Bill Gates, Steve Jobs, the Facebook guy, etc., etc., etc.

We keep coming back to the same idea- the little guy (that’s us) is getting screwed over by the rich (that’s “them”). The rich are the faceless bankers and Wall St types that live far away. We should “tax them to death” according to one poster. Well, fine, lets do that. Then what happens? Say we find a way to magically tax everyone making “a lot more than they need”. Since we’re all noble and true and middle class at best, lets say “rich” means you and your spouse make a total of more than $200K. (In St Lawrence Co $200K would be FABULOUSLY WEALTHY!!!) So nayways, the good old Gov’t steps in and takes these peoples excess, unneeded and, frankly, unclean money. Lets say it totals a little over a gazillion bucks. Then what? Yeah, we wiped out the deficit and we can fund everything from NPR to studying the mating habits of the Sidehill Wampus- for a year. What happens after that? You KNOW that as soon as there’s anything even remotely appearing to be an excess of revenue that there will be a sudden emergency need for a kagillion dollars to be spent on some Really Great Idea like Universal Single Payer Health Care, College, Nose Jobs and Hair Implants. Fantastic. Everyone is happy!

So, what happens next year? We already took all the money from the “rich”. Many of them are now “poor”, they’ve become “us” instead of “them”. But, we need more money to fund vital programs like teaching 6 year olds that the pedophile isn’t really bad, he’s just a victim. So who do we turn to then? We already wiped out the $200K+ class, so we go to the $100K+ class……oh crap, that’s not enough money…..lower it to $75K+……whoops…..alright, $50K and not a penny less…..well, I guess we’re going to have to raise the rates on those making at least $25K too. Eureka!!! See? It all worked out once we raised the marginal tax rate on pretty much everyone that breathes to 80%!!!

And here I was doubting this would work. Shame on me…

The facts contained in this article are very misleading. The author has carefully selected some data and has carefully constructed an argument for essentially class warfare and to what end?

The fact is we have a capital-based, market-driven economy. The economy flourishes on investments made in the manufacture of goods and the provision of services. In this system people are empowered with the liberty to choose their own path and make their own decisions. Some have taken a risk and made investments or started a business. In a vast majority of the cases those who have worked hard have earned their success. The result is that not only is wealth and prosperity created, people are fulfilled by doing what they choose, what they find rewarding. What a wonderful system! The wealthy are not bad people, they are a necessary ingredient to this investment-drive, market-based economy. Those currently at the lower end of the wage scale will do better as private investments continue and grow. Jobs are created are opportunities to pursue new wealth abound. This is where the focus should rest…how can we leverage and spur investment and incentivize hard work? That is how ALL will do well.

Bret, Bill Gates went to Harvard, Steve Jobs grew up in a city with a a median household income in excess of $100,000, Zuckerberg we already dealt with (Harvard, remember).

I asked “Show me a kid, other than an athlete or an entertainer, WHO WENT TO ONE OF THOSE SCHOOLS THAT WERE GOING TO CUT EDUCATION SPENDING AT, who made it big in one generation.”

This nation has become an oligarchy: only the offspring of the wealthy have any real chance.

And, Bret, what happens next? No way the rich would become poor in one tax year– they simply amass a little less.

This whole idea that the economy would grow if only we freed up more investment capital is proven false by the simple fact that American business is presently sitting on HUGE PILE OF CASH, but the economy is still in the doldrums. You could stop taxing business and capital gains tomorrow and it wouldn’t make a whit of difference.

What the economy needs is JOBS, and if private money isn’t creating them, the government needs to do it, and there’s plenty of infrastructure repair needed to create jobs– checked our bridges and highways lately?

Once regular people have jobs again, they’ll spend their paychecks on stuff (unlike the rich who just invest their cash), giving businesses a reason to hire again.

It’s called priming the pump, and it WORKS. The only reason the economy isn’t in better shape now is that the deficit hawks scared the administration into scaling back the pump-priming to the point where it fizzled out. Same thing happened under Herbert Hoover.

Rational, you’re describing how things USED to be. Now, we have socialized risk and privatized gain. When businesses make incredibly bad and even criminal decisions, that taxpayer bails them out, and they get to keep their massive salaries.

They have their compensation system so rigged that stockholders are no longer the primary beneficiaries of their scams, er, business activities– the CEO is.

I don’t know. The whole mess seems headed for a final collapse. With all production outsourced overseas, there will soon be too few people with money to spend in this country, and we’ll fade away into a banana republic. Unfortunately, we won’t even have the bananas to sell.

Personally I could work a lot harder and become a multi-millionaire in a year. But, I’m not going to because the government would simply take my money in taxes. So it’s my decision to remain a middle class worker.

Walker I could not disagree more. The government does not “create” anything. The government exists on funds (tax revenue) already in the money supply. Public sector jobs and public works jobs are using monies already created from the private sector. That is why the upstate economy is dying a slow death. I heard a speaker once say that “public sector employment is like being hungry and eating your arm to satisfy the hunger”. What happens when you get hungry again? You eat your next arm and so on and pretty soon you run out of something to eat…. Furthermore, public sector jobs are completely service related. Even public works projects (infrastructure – highways sewers, etc.) are in support of supplying a service. An economy at its core is based on production and manufacturing. We here in America have decided to send manufacturing off-shore. Why? We don’t like it. It is smelly, and unsightly. Let the the Chinese do it. We want to sit in our cafe’s and surf the internet on wi-if connected laptops but we don’t like to think of the manufacturing and raw materials (mining of minerals for batteries, etc.) that go into making that laptop and the antennae necessary for the signal to be transmitted. We need the private sector manufacturing as a core to our economy. We need goods and materials to supply the “things” that we purchase and use either for work or enjoyment.

this idea that “we don’t make anything anymore” is a very prevalent and pernicious falsehood. have a looky. u.s. manufacturing output was at an all-time high just prior to the crash in 2008. (well, ok, the chart only goes back to 1970, but i think this is a safe claim to presume from that.)

what’s true is that manufacturing employment has declined. but that’s a different ball of wax.

hermit….No not at a falsehood at all. Once more, the data cited is misleading. Yes, manufacturing is at an all time high, BUT, in what context? Look at the demand levels and total expenditures and you will find that as a percentage of goods manufactured and sold American manufacturing is in steady decline. Also, look at import/export data, we import vastly more goods (durable and disposable) than we export.

Sorry but your premise is flawed.

“Show me a kid, other than an athlete or an entertainer, who went to one of those schools that we’re going to cut education spending at, who made it big in one generation.”

Warren Buffet. University of Nebraska.

FYI – Bill Gates is a college drop out.

This on Buffet from Wikipedia is interesting:

“Even as a child, Buffett displayed an interest in making and saving money. He went door to door selling chewing gum, Coca-Cola, or weekly magazines. For a while, he worked in his grandfather’s grocery store. While still in high school, he carried out several successful money-making ideas: delivering newspapers, selling golfballs and stamps, and detailing cars, among them. Filing his first income tax return in 1944, Buffett took a $35 deduction for the use of his bicycle and watch on his paper route.[16] In 1945, in his sophomore year of high school, Buffett and a friend spent $25 to purchase a used pinball machine, which they placed in the local barber shop. Within months, they owned several machines in different barber shops.”

Paul, Buffet was the son of a businessman and four-term Republican United States Representative. He attended DC’s Woodrow Wilson High School back in the forties when it was lilly-white and serving wealthy and powerful Georgetown. Neither Gates nor Zuckerberg needed to finish college– they had such privileged upbringings, they were off and running as undergraduates.

So let’s have it, a kid who grew up in an ordinary middle-class family, went to an ordinary school of the type where we’re now busily slashing spending, who went on to achieve great wealth. You could try Bill Clinton– he’s ended up pretty well off. The point is, we’re not the land of opportunity we used to be because of accumulated wealth.

Jefferson saw it coming. He wrote “I hope we shall crush in its birth the aristocracy of our moneyed corporations, which dare already to challenge our government to a trial of strength, and bid defiance to the laws of our country.

khl:

“Ugh! Capital gains is only taxed at 15% as it is”

Yes, but tax cuts make people want to buy new furnaces, set up shop in an Economic Development Zone, buy clothes on tax-free day, etc.

Cutting the capital gain tax encourages capital investment.

r&l,

i’m really confused by your response. my comment was about the notion that “we don’t make anything anymore.” i think that the way to evaluate that claim is look exactly at… manufacturing output — do you disagree? and then i produced evidence showing that right up to the recession, the trend in u.s. manufacturing output was steady growth that had led up to an all-time high. so yes, the the idea that “we don’t make anything anymore” is a total falsehood. that’s all i was saying. of course there’s much more to this story to talk about, but none of it invalidates my point.

Walker, give it up.

If you really think they don’t exist, which I doubt, here is one for you.

Larry Ellison (look him up to learn about his lower middle class upbringing).

University of Illinois, two years, and one year at the University of Chicago. He is the fifth richest man in the world. No rich parents, no ivy league education. BTW Walker, at some Ivy league schools (Cornell as an example) if your combined family income is under $60,000 (and you have assets under 100K) do you know how much it costs for you to attend? It costs nothing! There are many opportunities out there for hard working Americans no matter where they come from.

I am sure, with your glass is half empty angle, you will find some obscure reason why this guy didn’t pull himself up by the seat of his pants like he did and succeed.

Im sure there are a couple of poor non/athletes non entertainers that have become rich, but the statistics are that we have a relatively poor rate of social mobility. We have a myth that any poor kid can grow up to be president or what ever, and we have had that myth for a long time, but it isnt true except in a purely technical sense. But that isnt to say that there is anything wrong with being rich, born or self-made. This stuff about class-warfare must come from some Glenn Beck whiteboard lecture.

Peter, exactly. Paul, congratulations! The point is precisely that examples used to abound. Today, not so much.

George Soros (btw another good example) says that there is class warfare alright, of the rich against the poor, and the rich are winning. Surely you’ve seen the data on the transfer of wealth from the middle class to the ultra-rich? You think this is a good and healthy trend, Paul?

A better question might be; is there someone who was wealthy and through being taxed(only) became poor or even middle class?

If its the poor and middle class fighting the class warfare, we are getting shellacked.

In theory, a flat tax is fair. In practice it isn’t fair.

It wouldn’t be fair if what is being taxed is already less than a person needs to purchase the basics of life – food, clothing and shelter.

The only way a flat tax could be made fair would be if the standard personal exemption was high enough to cover all of the basic need to live expenses. What would that be? $15,000 to $20,000 for a single person? Maybe another $10,000 or $15,000 for each dependent? Then a flat tax above that amount?

If you use any other standard, a flat tax would weight most heavily upon the poor and middle class.

Sales taxes and property taxes are a form of a flat tax and we know they weigh most heavily on the poor and middle class.

The problem is not really taxation. The problem is that we have an economic system that is wildly out of control and has created a vacuum that sucks the money out of the pockets of the poor and middle-class at an ever quickening rate and depositing it in the pockets of the very wealthy who have the terrible problem of not being able to spend it fast enough so they invest it in the wildly out of control poor-people-pocket-vacuum. The money moves through the markets in rapidly moving bubbles like some sort of Stephen Hawking nightmare spiking the price of consumer goods, driving businesses to cook their books in order to make balance sheets appear better and better each quarter so that investors wont dump their stock en mass resulting in the CEO having to find a new job. And when there is some sort of major collapse the poor suckers at the bottom have to clean things up while the golden parachutes keep the elites from harm.

The free-market is dead. There is no free market. There is a rigged market.

It’s not just on the bottom end that a flat tax isn’t fair. We have people pulling down tens of millions of dollars annually. Why should they pay the same percentage as someone making $40,000 per year?

The top rate was 90% in the Eisenhower years, and the economy did just fine thank you, and we used that money to build the Interstate Highway system. Granted, a lot was different then. But this current belief that keeping taxes low on the rich is absolutely essential for our economic well-being is garbage! Canada is in much better shape than we are presently, as is much of Europe. Explain that within the low-taxes-are-crucial framework.

KHL– Exactly right, though I think a graduated income tax is one of the few methods we have for putting a damper on such madness, that and the heavy hand of regulation. But as long as Republican spin doctors have the population hypnotized into voting against their self interest, and as long as we lack effective campaign finance reform, all this talk is just whistling in the wind, I fear.

I don’t think the free market is dead not even close. In the large picture every state and economy that has become more free, more open, and less controlled has created more wealth for more people and drawn huge huge amounts of people out of poverty. When societies have moved from planned economies totally controlled by the government to open economies where prices are set by the private market where what is produced is a function of what people want and are willing to pay for you have a tremendous move out of poverty.

The problem in my opinion is that we are moving away from a free market system when the government is involved in creating a socialistic system to prevent cronies from failing but giving the cronies all of the benefits of success. Small businesses get crushed under government regulations and large corporations who can pay the price to influence government gets huge subsidies. It goes back to government power and its abuse.

Take the health care law, now we find out that large corporations, large cities, large unions have all cut side deals to not have to implement the law, no side deals given to the small business though.

Walker-“Canada is in much better shape than we are presently, as is much of Europe. Explain that within the low-taxes-are-crucial framework.”

Because Canada and the still solvent European countries didn’t let a bunch of social engineering wealth redistribution idiots in their gov’t pass laws that not only encouraged but demanded really stupid loans be made to people who couldn’t possibly hope to pay them back and then pass laws that allowed those loans to be bundled as capital and then move to get the Gov’t to underwrite these stupid loans all while spending gazillions of dollars that they couldn’t actually back to push more social engineering, prop up failing businesses and banks and while fighting 2 wars…all while the politicians that introduced, passed and supported the stupid laws and regulations managed to profit from all this. And then, when it finally became apparent to the densest of the dense that the system was about to collapse they didn’t start printing MORE worthless currency because THEY were smart enough to know that devaluing your currency has some real nasty side effects.

IOW, in a nutshell, Canada and the still solvent European countries took a far more conservative view of things in this line than the plastic haired wonder bunnies in our gov’t.

As Mark Twain said, “Suppose you were and idiot, and suppose you were a member of the United States Congress….but then I repeat myself…”