Youth unemployment: for real?

Last week we kicked off a series of posts exploring youth unemployment with an inspiring introduction to the (dis-) encouraging situation. If that isn’t enough to keep your eyeballs, then you’re heartless.

Youth unemployment is NOT a myth.

Everyone talks about it, but does anyone have the real facts and figures? It reminds me of politics—I’m all talk until I’m expected to explain how the Electoral College goes down.

Let’s give this conversation some context. As of July 2013, the youth unemployment rate was 16.3 percent. That is double the national unemployment rate for people over 25 years old.

For those youth who are employed, the most common industry they can be spotted in is “leisure and hospitality” followed by “retail trade.” After a process of pestering our station manager Ellen for this position, I feel lucky to have become an outlier in this labor force.

My simple and elegant title, NCPR intern, will soon be re-stated as “Features Reporter Assistant and Intermediate Web Content Producer/Coffee Bean Grinder”. I’m doing big things.

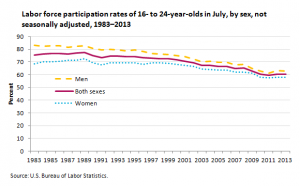

It seems spot on that youth are either working in restaurants or retail, but, as you can tell, youth labor force participation has been in steady decline.

Since we aren’t working, we have gone into hiding.

Where? Why not the most rent-free, enabling environment we could find. My gracious father placed a six month maximum on post-grad stay-time in our family home. This system has worked for all the siblings before me. Scare tactics are real, and they work.

In a New York Times article, a not so recent graduate of the boomerang generation explains her short journey from Loyola University, Chicago back to her hometown of Downers Grove, Illinois. The Times reminded us that “One in five people in their 20s and early 30s is currently living with his or her parents.” In order to not be misleading, Chicago does have the highest unemployment rate, 16.9%, out of the 50 largest cities.

The windy city is suffering, but so are we in the North Country. Out of New York State Counties, Bronx County has the highest unemployment rate clocking in at 12.1%, while St. Lawrence County comes in at a close second with 9.8%.

Naturally, let’s point fingers! Are student loans to blame? Or, the lingering aftermath of the 2008 recession? Or youth themselves—too eager or feeling entitled? I’ll place my bets on a lethal concoction of everything bad, ever, that happened to the labor force and economy.

How do student loans affect your job search? Or are they hindering your optimism before you even have a chance to graduate? Let’s get a conversation going about this, and in two short weeks I’ll be back to give you a pat on the back and tell you “it all might work out for us?!”

The coffee was good this morning Mo–keep up the good work! 😉

I concur, delicious … if you ever want to discuss the workings of the Electoral College then let me know, it’s simpler than they let on.

If I have to lend you $10 out of my Student Loan so you can pay your rent every month, I will.

But anyways, I think the real issue is that we all have no idea how to manage our money. I’m 21 and I still can’t budget. I’m living with the expectation that my future self will be able to handle it. Or that I am going to have a magical profession drop on my lap to just “cover it.” What about interest on that $32,000??? When am I going to have time to save for a down payment???? If someone taught me this stuff 5 years ago.. in high school, I may have not appreciated it or cared but maybe I wouldn’t still be standing here with no clue. But guess what? The economy runs on suckers like me “spending money” so educating me on how not to wouldn’t really be beneficial now would it….

My answer is self-education. Self-employment. Self-advocacy. If you want a job, you are going to have to bug Ellen to grind coffee beans every day for as long as it takes her to say yes.

Because at the end of the day, saying “you have a 6-month cap on your stay-time post-grad” really means “Get your ass is gear kid. This life ain’t got no time for the lazy or unmotivated.”

Well said, Emily!

As a 28 year old, I can honestly say that I still have trouble budgeting. It takes time, and there’s always something going on! This friend’t birthday dinner or that friend’s wedding, just being able to go to the movies this night or out for a few drinks to see friends that you have not in a while on another night. It adds up, quick. Prioritizing is the key, along with a stable working situation that allows for that. I just missed your “generation” of work issues, got into the professional workforce prior to the economic collapse (barely) and I am grateful for the experiences it afforded me to get where I am today.