Let’s talk about the cost of college

With the news earlier this week that Cooper Union in New York City, one of the few tuition-free institutions left in the country, was planning to start charging tuition next year, I was reminded of the incredible gift I enjoyed at the then tuition-free City College of New York, back in the day when the only cost was a $35 per semester registration fee and the price of books.

Today, in our region, we have private and SUNY options. Here’s a quick overview of what those annual prices look like for NYS residents (these are approximate, use links for complete figures):

SUNY Canton–Tuition & fees: $5,570; Housing/meals: $5,300

SUNY Potsdam–Tuition & fees: $7,175; Housing/meals: $10,500

SUNY Plattsburgh–Tuitiion & fees: $6,800; Housing/meals: $10,600

North Country Community College–Tuition & fees: $4,700; Housing/meals: information unavailable

Paul Smiths College–Tuition: $21,930; Housing/meals: $10,300

Clarkson University–Tuition: $40,540; Housing/meals: $13,300

St. Lawrence University–Tuition & fees: $44,450; Housing/meals: $11,500

Whether or not you are facing the tuition burden directly, it affects all of us. The impact on families helping put young people through college and, of course, the heavy debt load so many graduates now face, is having a significant impact on our society and economy.

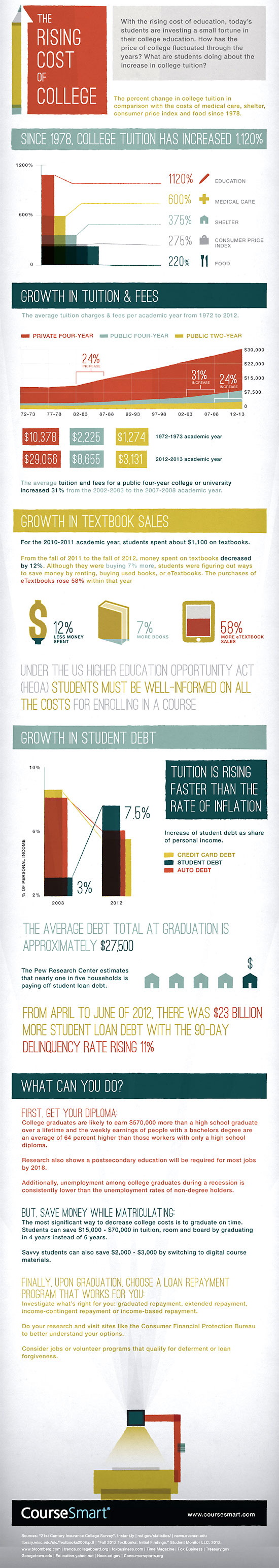

Here’s an interesting article from dailyfinance.com that explores the rising cost of tuition and the impact on our country. Really worth a read. Here is some of the graphic data provided in the article–a great overview of the situation.

Here’s another article of interest on this subject, from the American Enterprise Institute; this one from the Council on Foreign Relations which focuses on the challenges facing our country’s standing on the global stage; and this from education.com, which explores the public’s tendency to see college as unaffordable–a perception that is often inaccurate.

Tags: american enterprise institute, Clarkson, college tuition, education.com, Paul Smith's College, SLU, SUNY, www.dailyfinance.com

I find it interesting that the options listed under the “What You Can Do” section do not include alternatives to traditional education or to the traditional model of attending college full time immediately after high school. Everything in our society currently pushes students from Kindergarten on into the college machine even though a liberal arts education may not be the best option for many people, especially considering the enormous costs of college and the reduced earning power of the American worker today.

My daughter graduates high school this year and up until November we all assumed that she would be going into college next fall, too. But she has since decided that she will seek real-world and apprenticeship style experience in her fields of interest (music & drama) for a couple of years before making the decision to lock herself into a 4 year program and decade (or more) of college debt. Considering how many young students change majors, supplement their resources with credit card debt and take longer than expected to complete degrees that don’t result in lucrative careers, I think it is a wise decision. She’s getting a lot of flack for it in some other quarters, though. I really think that we need to teach our students that it is O.K. to take some time exploring options, look at “non-traditional” modes of education and get some experience managing finances & being a grown up before they accumulate debt.

Its sad that college is no longer an education, but has morphed into very expensive job training. When I went to University of California, it cost $45/quarter. I didnt think about the money. When my kids went to college – one private, one SUNY the costs – especially the private one – were astronomical and I definitely thought about them. (although the kids didnt – which is good – and they didnt end up with undergraduate student loans, which I feel good about still). That many 18-year olds are faced with taking on $50,000 to $100,000 in debt is shameful for us as a country. I dont know what the solution is.

Could it be that colleges and the “financial industry” have been in cahoots for the past few decades to convince people that “everyone” should go to college? First they have to convince parents that if their kids don’t go to college they will be left behind. Then they have to convince parents that they must start saving for college (along with needing $1 million for retirement). Then you give all that money to the schools, many of the same schools that have multi-billion dollar endowments.

Where does all that money go? Wall Street! How about that? Who would’ve guessed it.

Now, I am not saying that nobody should go to college. We certainly need highly educated people across the full spectrum of jobs in our society. And on average college grads may well do better than students with just a high school diploma. But that is just on average. So the finance major who ends up averaging $250,000 per year across his career gets averaged in with the art major who ends up averaging $30,000 per year across his career.

Both of those students incurred expenses and debt which takes years to pay off.

But what if we compare that with someone who becomes an apprentice through a unionized trade? That person will start making money right away without incurring the same level of debt or costs. Maybe toward the end of their career the college grad pulls ahead of them on yearly earnings but while the college grad is paying off debt the tradesman may have bought a house and built equity.

Adults need to be realistic with what they tell young people. They aren’t all above average, and even some of the kids who are well above average will be happier going to a 2 year school or trade school or other alternative training. Many, many more people need to be given the skills to open their own businesses and work for themselves and stay out of the clutches of the Capital Vampires that want to suck at their lifetime earnings.

Really scary stuff. Started college funds years ago but they don’t really come close to covering costs. Oldest daughter a junior at a $55k/yr school…NUTs…thank god NROTC covers that one. Next one will be in school next year and had her choice of many institutions, all $45k/yr ++. Financial aid packages are profoundly insulting in that they think the family loading up on $30k/yr in loans is OK (I must have “stupid” tattooed on my e-forehead!) Another ‘Thank god’ in that she’s choosing value over other, more nebulous characteristics (Geneseo). Number three? Maybe she’ll be the smart one and become a plumber!

Some important points here:

Parents need to communicate to their children exactly how much their student loan payment will be post-graduation. Students should know how old they will be when their loan payments will end.

St. Lawrence University’s recruiting is especially unethical in this respect. They tell their recruiters and assistant coaches (who are really recruiters) to blend loans and scholarships under a single term “Aid”. There’s a big difference between loans and scholarships.

Students should learn to borrow the minimum in living expenses. There are plenty of kids walking around campuses with iPhones and ‘Beats by Dre’ headphones that were bought with student loans. When I taught for SUNY Potsdam we had an hourly worker who lived with his parents, but borrowed the maximum in living expenses each semester. He would carry it around in $100 bills in his wallet.

There also needs to be legislation that says any scholarships/ Pell grants/ etc. will turn into loans if a student fails out. This is the most infuriating part of college funding to me, as a professor. Nobody tries hard and fails out of college any more. Students who fail out of college do so because they simply don’t attend classes and turn in assignments. I totally think poor kids should get help, but at the same time they have no sense of commitment because it’s not like they are vested in their educations.