Republicans and “smart people”

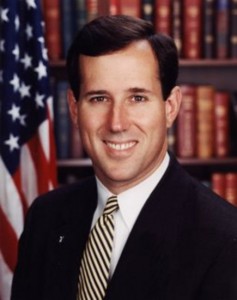

Last week at the Values Voter summit in Washington DC, former senator and presidential candidate Rick Santorum threw out a startling idea.

Last week at the Values Voter summit in Washington DC, former senator and presidential candidate Rick Santorum threw out a startling idea.

“We will never have the elite, smart people on our side,” Santorum declared. He didn’t really mean, of course, that conservative voters are dumb, or simple-minded.

He meant that liberals — and “media elites” — are made up of eggheads and bossy parkers. You know, the kind of people who use phrases like “bossy parker.”

But Santorum’s analysis does get at a growing conundrum in the conservative movement.

As American society grows more educated (slowly), and more urban (rapidly), the GOP is finding it difficult to connect not just with ivory tower intellectuals, or minorities, but with people who live and work in our nation’s most productive communities.

The lion’s share of all productivity in the US — about two-thirds — happens in a relatively small group of about fifteen powerhouse states, with California at the top of the list and Maryland at the bottom.

I include these fifteen because all produce at least 2% of US GDP, and most are also home to important technology, government, media or cultural clusters.

Using Europe as an analogy, these are the Germanies and the Frances. The other thirty-five states (sorry, guys) are the Portugals and the Greeces, in terms of wealth production, exports, innovation, and industrial output.

And of those 15 dynamo states, nine are now reliably Democratic, producing more than 42% of everything that Americans make.

Meanwhile, only two of the heavy-lifter states — Texas and Georgia — are dependably Republican, producing just under 11% of US GDP.

What’s interesting here is that only a few presidential cycles ago, this picture looked very different. Conservatives could more or less rely on Virginia and North Carolina. Ohio also leaned toward the GOP.

And even Florida had an arguably Republican tilt, voting Democratic in presidential elections only three times since 1968.

With those states in their column, “conservative GDP” used to look far more robust, around 25% of national GDP

But now, those states are all true-purple battlegrounds. More troubling yet for Republicans, they are drifting toward the Democratic column in large part because their most productive urban and suburban communities are — you guessed it — increasingly Democratic.

Now this one statistic alone is simplistic, to be sure, and only gives part of the picture. A recent NYTimes/CBS poll found that Mitt Romney is actually leading by a sizable margin with affluent Americans.

The poll found that Mr. Obama holds an advantage of 21 percentage points over Mr. Romney among voters whose household income is under $50,000. Mr. Romney has an edge in higher income groups, including leading Mr. Obama by 16 percentage points among voters whose household income is more than $100,000.

So Republicans are, obviously, still attracting a lot of successful, productive and — dare I say it — really smart voters. But one of the things that we’ve learned in recent years is that prosperity and growth appear to be happening more and more often in clusters.

Millionaires matter, but so do big collections of well-trained, motivated rank-and-file workers. And increasingly, people who gather in those kinds of places tend to vote for people with policies more like Barack Obama’s than Mitt Romney’s.

What does this all mean in policy terms, and in the framing of American elections? Maybe a lot.

Some moderate Republicans have suggested that the GOP will have to bend its platform in the future to appeal more to urbanites and to minorities.

But maybe a more palatable approach for conservatives would be to set a goal of winning more campaigns in the nation’s most affluent, productive communities.

Saying, “Let’s appeal to Hispanics” may sound like pandering.

But saying, “Let’s rally around those ideas that appeal to smart voters, regardless of race, who produce most of the goods and services in America” — that sounds like a bedrock Republican principle.

Tags: election12

wj yes the numbers are important.

However I think you underestimate the social and cultural appeal and also the self identification (tribalism) of part of the electorate. I am a conservative because that is what I am as a regular down to earth hard working patriotic American. I am a Liberal because it is who I am as a smart sophisticated voter and so forth.

On a slightly different although related topic, I know Romney is getting a lot of flak for his honest words, but it is the first thing he has said that does not sound phoney to me.

Half the public does not participate in the federal income tax, this is a problem in a participatory democracy. We all have to have a stake no matter how minimal, we all have to have skin in the game so to speak.

The corporate tax issue you mention is a big one, but I think it shows the issue that tax rates don’t tell the story. The US has one of the highest Corporate tax rates in the developed world, yet as you point out a lot of large corporations don’t pay very much or any taxes. Higher rates are not always the answer, corporations and the very wealthy have highly mobile assets.

Come on, Mervel, we’ve been through this a bunch of times. We have the highest corporate tax rates in the world only on paper; we have so many loopholes and subsidies that our effective corporate tax rate is one of the lowest in the industrialized world.

Mervel, you can’t have missed the fact that there is a whole lot more tax out there than Federal Income Tax, and that virtually everyone is paying substantial amounts in payroll taxes (something Romney pays none of) and sales and property taxes.

Conservatives are constantly treating Social Security and Medicare as a part of our debt problem, but then pretend that the payroll taxes that fund them are not part of the budget– they don’t give you “skin in the game.” Ridiculous!

Even David Brooks gets it: “Who are these freeloaders [Romney is speaking of]? Is it the Iraq war veteran who goes to the V.A.? Is it the student getting a loan to go to college? Is it the retiree on Social Security or Medicare?… The people who receive the disproportionate share of government spending are not big-government lovers. They are Republicans. They are senior citizens. They are white men with high school degrees. As Bill Galston of the Brookings Institution has noted, the people who have benefited from the entitlements explosion are middle-class workers, more so than the dependent poor.” (Thurston Howell Romney)

Romney sounded more honest than usual because he was speaking to a room full of rich Republican voters– he never expected to have to explain his remarks to the 47% of Americans who, he feels, can never be convinced that “they should take personal responsibility and care for their lives.” Incredible! Thurston Howell indeed.

Walker: “we have so many loopholes and subsidies that our effective corporate tax rate is one of the lowest in the industrialized world.”

Good argument against Obama’s “tax the wealthy”.

They will just go somewhere else where they are not taxed.

47% of Americans pay no Federal income tax and the other 53% lie about it.

I know there are plenty of Republicans that might be called “smart”, but I prefer the words “nefarious, avaricious, scheming” or even “subversive”. They have an agenda, and it only involves the rest of the population when votes are needed. The dumb ones, the ones who swallow the line no matter how preposterous, are called sheep.

tootightmike, the Democrats don’t have an agenda?

Taxes (and real estate prices) in New York City are about as high as they get. I haven’t noticed the rich fleeing the city in droves, have you?

The big problem with “Raise Taxes and the Rich Will Flee” idea is that taxes in the U.S. are presently at historic lows. Why didn’t the rich leave when Clinton raised taxes? Or George HW Bush? Or Reagan? How did we keep any rich folk around under Eisenhower’s 95% top marginal tax rate? The claim is clearly counterfactual.

They will just go somewhere else where they are not taxed.

If I remember correctly, NYS recently extended a “millionaire’s tax”. Did all those millionaires leave NY?

http://blogs.wsj.com/wealth/2011/02/23/new-yorks-vanishing-millionaires-and-other-myths/

“Did all those millionaires leave NY? ”

No, there are plenty of ways to avoid that tax. On paper many of our millionaires probably make $249,999.99 a year. Many of them probably “live” in Monaco.

Not really sure I would call it a myth:

“The number of Americans seeking to renounce their citizenship surged to more than 1,700 last year, more than twice the rate of 2009, according to U.S. Treasury data compiled by Andrew Mitchel, the international tax attorney. Among them was Eduardo Saverin, the Facebook[FB 21.7285 0.2085 (+0.97%) ] billionaire who famously moved to Singapore before giving up his citizenship late last year. This year, 460 people expatriated in the first quarter alone. ”

http://www.cnbc.com/id/47599766/The_Mass_Migration_of_the_Super_Rich

Walker: “I haven’t noticed the rich fleeing the city in droves, have you?”

They started parking their yachts next to John Kerry’s.

Well, Paul, I sure wouldn’t want such super-patriots to stay, would you? How much of their wealth are they currently spending in the U.S. anyway? And what are the odds that they’ll give up their U.S. residences when they move? I would be interesting to know just how much of a loss those 1,700 would amount to, taken all together.

The issue here is how “smart” people behave.

Smart people see how much of a rat hole the government is and don’t care to give another dime to such a wasteful organization.

Can you imagine.

What if our county government spent $50 mil of our tax money to fund a manufacturing company that built a building, hired 200 workers, and declared bankrupcy? (and the CEO walked away with full pay and retirement)

And then, the same county legislators had the gall to ask for re-election and a tax increase of 10%, and said, “whoops, we can’t control the private sector”.

I think the tax payers would be inclined to fire the whole lot of them.

It’s amazing how excited “conservatives” get about that $50 million Solyndra deal while completely ignoring the billions that disappeared into Halliburton and Blackwater, er, Xe Services, er Academi (Academi?! What are they, a college?!)

Walker: so is it smart to send more money to government?

Walker,

I realize that we all pay a variety of taxes, federal income, state, local, Social Security, medicare etc. However the federal income tax is what we are usually speaking of and the fact is how can we have a national discussion about something that close to half of the population does not even participate in? Now I am not proposing that we have some sort of massive increase but the fact is everyone who has income should pay something in federal income taxes (even if its $20).

If you perceive that your income and financial security are largely dependent on the federal government’s payments to you, you are never going to vote for someone who is saying I am going to reduce those payments. I think Romney’s numbers are off, but his logic on that point is sound. It’s one of the reasons he is going to lose.

Not to say that Republicans don’t have their customers also, Defense contractors, oil companies, agri-business, all get payments from the Republicans, thus they will always support those who promise to keep those particular payments.

“Well, Paul, I sure wouldn’t want such super-patriots to stay, would you? How much of their wealth are they currently spending in the U.S. anyway? And what are the odds that they’ll give up their U.S. residences when they move? I would be interesting to know just how much of a loss those 1,700 would amount to, taken all together.”

Walker, yes these are all interesting questions I was simply pointing out that there could be this effect since there appears to be data to support it. Is it significant? I don’t know.

” Now I am not proposing that we have some sort of massive increase but the fact is everyone who has income should pay something in federal income taxes (even if its $20).”

So would you be happier if we stopped collecting payroll taxes and shifted SSI and Medicare taxes to the Federal Income tax? Then you would grant that we all have “skin in the game?”

What difference does it make? Taxes is taxes.

No I would be happier if everyone who had income paid an income tax even if it were minimal. We should be raising Social Security and and Medicare/Medicaid taxes.

Taxes are not just taxes. I don’t have to pay state income tax for example, none of us do, we choose to pay state income taxes by living in a state that imposes one. My vote for president has no impact on my state income tax or my property taxes or my sales taxes, it only has an impact on my federal income taxes and Payroll taxes. Thus from a national point of view it is an important tax that everyone as citizens should have to pay.

“My vote for president has no impact on my state income tax or my property taxes or my sales taxes…”

Sure it does: ever hear of revenue sharing? It was in place from 1972 to 1986 until Ronald Reagan killed it, causing state taxes and probably property taxes to go up as well. And there are many, many examples of federal funds going to state governments, undoubtedly having an impact on state taxes.

Of the Republicans candidates so eagerly vying for the opportunity to remove POTUS Obama from the White House, in contention from 2011 through 2012, (Ron Paul, Newt Gingrich, Rick Santorum, Buddy Roemer, Rick Perry, John Huntsman, Michele Bachmann, Gary Johnson, Herman Cain, Thaddeus McCotter, Tim Pawlenty and of course Mitt Romney) was there a choice less likely to have engaged in self-immolation than the current Republican POTUS want-to-be?

If the Republicans were offered a chance to do-over the Primaries would they? If so who would be given the nod the second time around?

I guess Romney once again proved with his 47% observation that he is too dumb to be President.

It’s not like the Federal government doesn’t have enough money.

We have a spending problem.

Cutting taxes doesn’t equal cutting services. It means cutting waste.

“We have a spending problem. Cutting taxes doesn’t equal cutting services. It means cutting waste.”

Well sure, but one man’s waste is another man’s treasure. I’m all for cutting our bloated military and instituting single-payer health care.

It’s easy to say “cut waste” but it’s not so easy to do.

I think even if you have a flat tax you should not impose a federal tax burden below a certain income level. They have skin in the game without a federal income tax bill. Mervel, I can see where you are coming from but it would probably cost us 100 bucks to collect the 20 dollars given how our taxation system is designed.

It looks like the president may get a shot at his tax policy so I guess we will see how it works out.

Right now one of the biggest issues for lower income people is the price of gasoline. And there they are paying a hefty tax.

I don’t know those comments of Rommey make me like him more, its the first honest thing he has said. He is correct, he is not going to get the vote of people who are going to lose their income if he is elected.

But yeah if I am not paying ANY federal income tax who am I to tell someone they should pay more?

Mervel, he didn’t say “he is not going to get the vote of people who are going to lose their income if he is elected.”

He said “My job is not to worry about those people. I’ll never convince them they should take personal responsibility and care for their lives.” Meaning you, Mervel. Because you don’t pay any income tax, you obviously don’t take personal responsibility. And you believe that government has a responsibility to care for you, and you believe that you are entitled to health care, food and housing and whatever. You don’t take offense at that?

I don’t know who Romney’s talking about anyway! I’ve had every kind of income over the years and even in very lean years, I paid taxes.

He honestly believes, he will never convince a good portion of the electorate, probably around 47% that he is going to be good for them. He is offering them nothing but cuts and the alternative is that for them they will be on their own, either when it comes to health care or jobs or their education etc. So given that he can’t get the lower middle income social conservatives, who does he have left?

He is also correct you have a small group in the middle actually upper middle, between 4-8% who are very important.

Which is why the Republicans can’t win with a pro-business moderate like Mitt. Santorum would have done better although probably he would also have lost.

But the election at this point is basically over, Mitt basically already called it.

Walker: “It’s easy to say “cut waste” but it’s not so easy to do.”

It’s rather easy. The adults in the room simply vote people in who lower taxes.

The babies in government react by bellyaching and threatening to cut the most vital services.

The adults in the room vote them out of office.

This evolution thing hasn’t worked out so well. Somehow, it is the babies that get elected to higher office.

Well JDM, what you think makes one side “adults” and the other side “babies” is anything but obvious and objective. When you want to talk fact, let me know.

There are age limitations to many government jobs and babies typically do not qualify. Usually you must be at least 18, with higher age limits for Senate, President.