Sorry, Dems. The problem really is entitlement spending.

President Barack Obama just destroyed the Republican Party for its fickle, muddled and ultimately incoherent stand on the fiscal cliff.

It’s likely that the White House will make the GOP look stupid, weak or worse yet, radical again over the debt ceiling.

In the midst of a fragile global economic recovery, no one with a lick of common sense wants the United States of America to default on its debts.

The weird thing about these Democratic victories is that, in broad terms, Republicans and conservatives are in the right.

Our fundamental fiscal problem really is out of control spending on social programs, and not taxation or the size of the US military.

Here are the basic facts.

Through post-War American history, tax receipts to the US treasury and total Federal spending have remained fairly stable, floating between 15% and 20% of GDP.

From the Great Society years through the era of Newt Gingrich and the Republican renaissance — and despite all the ideological debates — government remained remarkably stable in size.

That’s according to figures compiled by the White House itself.

Yes, the Bush tax cuts pushed us from the higher end of that scale (around 20.6% of GDP) down toward the middle of that scale (taxation around 17.6% of GDP).

Which was problematic, given that President George W. Bush exploded spending, boosting entitlements and launching a couple of wars that he had no practical way to pay for.

And yes, the Obama tax cuts — passed as part of the controversial stimulus — helped push revenue even lower, down to around 15.1% of GDP.

This at a time when he too blew up spending, paying for a vast array of programs designed to keep the domestic economy from tanking.

But it’s important to note that taxation, even through this hardscrabble period, remained in the range that was recognizably “normal.”

By the White House’s numbers, however, Federal spending has now ballooned to well over 24% of GDP. That’s far outside what you might describe as the “social contract” range for America’s post-war society.

Indeed, Federal spending hasn’t been this high, as a percentage of GDP, since 1946. When you factor in state and local government spending, the public sector’s role in our economy has reached levels not seen since World War 2.

Which is a problem. Even if we bring taxation back up to the historic high-end level of around 20% of GDP, America will face deficits of between 2% and 4% of our entire economy into the foreseeable future.

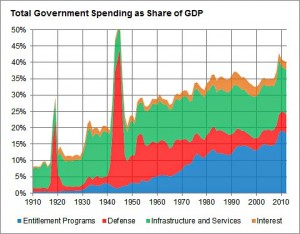

Nate Silver’s graph captures the rise of entitlement spending in American government. It now comprises one in five dollars spent on government. (Source: NYT)

That is — in layman’s terms — a massive and unsustainable level of debt-building. It just won’t work.

Liberals have tried to argue that the debt problem is a short-term crisis caused by low Bush-era taxation and a bubble of stimulus spending.

The economy will recover, more people will go back to work, the ship will right itself — especially if we just boost taxes a bit to close the gap.

Unfortunately, the numbers say otherwise.

Nate Silver, the esteemed New York Times statistician, just published a devastating essay showing the rapid and long-term increase in spending on entitlement programs.

He points out that when you include local and state spending, social entitlement and welfare programs already represent nearly 20% of GDP.

“Spending on entitlement programs was about $500 billion per year in 1972 in today’s dollars,” Silver writes.

“If it had increased at the same rate as the gross domestic product, it would now be about $1.4 trillion. Instead, it is now about $2.9 trillion per year. What this means is that there has been about a $1.5 trillion increase in entitlement spending above and beyond gross domestic product growth.”

In other words, every single year since 1972, we’ve added roughly $38 billion to the cost of entitlement programs, again and again and again, and that’s beyond the rate of inflation. With our aging population, that number is only expected to grow.

By way of contrast, military spending, as a percentage of GDP, has been stable or declining for decades.

So why aren’t Republicans winning this fight? Several reasons.

First, they haven’t confronted their own history. Yes, Barack Obama’s stimulus spending ballooned government spending as a share of GDP. But George W. Bush was no piker.

He added $900 billion worth of red ink during the final year of his presidency alone.

The GOP has also resisted even modest calls to cut the size of the US military, despite the fact that we’re winding down two wars, are in something akin to peace time and currently spend more on defense than the next ten nations in the world combined.

Meanwhile, Republicans continue to lavish attention on symbolic budget cutting gestures — public broadcasting, Planned Parenthood, etc. — and on ludicrous proposals that tax revenues be cut even further.

This posture has made it all but impossible for conservatives to propose the kind of serious, credible and (yes) painful budgets that would bring social spending back into line with historic norms.

I suspect Republicans could regain the high ground very quickly.

First by arguing for comprehensive tax reform –simplifying the system, closing loopholes, modest and targeted tax rate hikes, etc. — that would bring overall Federal revenues back to roughly 19% of GDP.

That’s the level we saw during the first three years of Ronald Reagan’s presidency.

Second, by pushing for balanced spending reductions that phase in cuts of roughly 1% of GDP per year, bringing Federal spending down to about 19% of GDP by 2018.

A serious proposal of this kind would mean abandoning Ayn Randian fantasies about returning the public sector to the role it held prior to the New Deal. (In the early 1930s, Federal spending was only about 3% of GDP.)

But a credible budget balancing plan would also force Democrats to engage with a real and credible set of fiscal arguments about the limitations of government.

The days where Barack Obama could shadow box with tea partiers in Ben Franklin costumes would be over.

By phasing the cuts in slowly, we would also avoid the kind of “austerity cliff” that has crippled the recovery in parts of Europe.

As a final note, it’s an open question whether Democrats in Washington might try to grapple with some of these fiscal realities on their own.

I know conservatives are deeply skeptical about this. But California’s Democratic governor, Jerry Brown, worked with a Democratic legislature to rein in his state’s fiscal crisis — through big tax hikes but also through massive cuts to social spending.

That state is now expected to post significant surpluses.

And New York’s Democratic governor, Andrew Cuomo has done much the same, taking on public sector unions over wages and benefits, curtailing pension costs, capping local property taxes, and adopting something resembling fiscal discipline.

Is it possible that President Obama, in his second term, might lay out a plan that would follow this Democratic model, stabilizing America’s long-term fiscal health?

We may get our first answers to that question when Mr. Obama gives his second inaugural address on Monday.

Tags: government, spending

Fix double digit rises in overall health care costs, fix the “entitlement” problem.

Medicare for all. Group barganing for prescription meds.

Yeah, taxing GE and others would help, a little, too. And I’d really like to see the federal government stop giving oil companies billions of dollars a year in tax breaks and subsidies, but that revenue’s little more than a drop in the bucket.

Brian lays it out pretty well. We have to cut spending.

Any volunteers?

And there’s the problem.

AND the massively bloated “defense” budget. How about we cut that and other forms of corporate welfare first? That would give “entitlement” cuts a little more credibility.

Though Verplanck’s idea would make a significant improvement too.

We have to get health care costs under control. That’s the biggest part of the increase. Republicans are going to have help rather than hinder.

The two big problems Nate Silver mentions in that essay are health care and state/local pensions. The Republican’s, “we have a spending problem” doesn’t really help. Their idea is to cut “welfare” assistance to the poor for moral reasons. I don’t know how you deal with local pensions.

The military could be cut dramatically by eliminating the Army.

Why the Army?

Because it offers the excuse of limited warfare. First it is a couple of “boots on the ground.” Before you know it, the “boots on the ground” escalates to 10, 50 and soon over 100 thousand.

If we had only the Air Force and Navy, enemies would know that if they screw with us, they will be toast.

Our politicians would know that going to war is serious business.

Health care costs are critical. Social Security can be fixed in isolation just by changing the formula (no one will like it but it is doable). Medicare and Medicaid and now Obamacare are different and will explode even more than we currently have. The disturbing part is that right now according to the chart we are reaching WWII levels of spending per GDP and we are not fighting a world wide war, we are just spending.

If he does not bring it under control it may really impact his legacy, the we are not Greece naysayers I hope ARE right, but what if they are wrong, what if we are headed for a Greece style meltdown?

If we have to pay more taxes to fund Bush’s war then so be it…and lets resolve never to do that again. Someone that dumb should never have a credit card.

When I look at the chart above, I don’t see military spending holding a level…I see it rising dramatically since 2000, and the comparable rise in entitlement programs might just be found to track the maimed, wounded, and traumatized who returned from these wars.

Cutting military spending in a meaningful way will certainly put thousands out of work, but cutting entitlement spending will put millions out of their homes. In either case the rich will grow richer as they control the strings that support both sides of the discussion.

Far too many in the “healthcare industry” are growing rich, but know nothing about medicine. The insurance providers should have been put out of the health game by creating a single payer system, but we adopted a republican style program which is designed to line the pockets of the country club set at the expense of the sick, old, and all other tax payers.

And all this talk about fixing Social Security is just a continuation of the talk. We’ve resisted all attempts to adjust the rates for as long as I can remember…always predicting some future collapse, but never making the really small incremental adjustments that were necessary.

Now, the Republicans want to do something dramatic…raise the eligibility age, cut the raises, whatever, and they want to do it on the backs of those who’ve already worked their lives away, investing in what was perceived as a done-deal. I say talk to an 18 year old. Don’t talk to me. I’ve already done my part. Don’t threaten MY investment. I AM entitled! You want to find out how many old guys have guns…mess with our Social Security!

Mr Silvers article fails to take into account that spending on social safety net type programs goes up during an economic downturn. This keeps people in their homes.

The war spending led to the uncertainty in the worlds financial markets. The uncertainty led to recession. Recession led to escalated social spending. and increased spending led to the deficit. Continuing uncertainty limits investment, and lengthens the recession. It’s not rocket science, and it’s not ideology unless you blame it on teachers unions instead of military adventures.

Local governments complain bitterly about unfunded mandates, but the underfunded pension plans are all on the local governments and a big part of the entitlement deficit.

We have to do both cut defense Medicare and Medicaid . Brian has a good point the math is not there without cutting in all of these areas. Why hasn’t defense spending dropped precipitously since we pulled out of Iraq? The fact is Obama is going to rack up a lot more debt than Bush. Bush is no longer relevant to any of these discussions as far as the debt goes.

Make a few minor changes to entitlement programs or go down the tubes. We only need deficit spending if we have a war. a think we are done in that regard.

Bush will remain relevant until we come up with a spare six to ten trillion dollars. He will remain relevant until the global economy recovers to the point of having that kind of surplus kicking around again.

I wonder it we have another Nate Silver moment here. For the 18 months or so leading up to the November election, virtually all the “grownups” in the media were all about it’s so doggone close, and Obama’s in Big Trouble, and, until the last couple of months, Romney’s practically a shoe-in (Brian Mann being an exception, and not a national “grownup”.) One exception was Nate Silver. I followed him back when he was a near-nobody called “Pobblamo” on DailyKos.com, before the ’08 election, which everyone knows he called 98% correctly, and I knew that Nate was usually right before hardly anyone paid any attention to him I didn’t know anything about predicting the election, but I knew how to find someone who had an excellent historical record at doing it. Nate, and those of us who followed Nate, were right. Since we can’t know a whole lot ourselves, it makes sense to respect the opinions of those with a track record of being right on issues they claim expertise on.

Duh.

(I think Nate pretty much blew his NFL playoff predictions, BTW).

.

Since forever almost all the “grownups” , especially the conservative grownups, have been predicting economic catastrophe because of the deficit and entitlements, and all that stuff. “Cut taxes and govt. spending! That’s the answer!” That might make sense to me, but for the predictions of one Paul Krugman, Nobe Prize winning liberal economic columnist for the NYT. Krugman, like Silver, has a pretty good history prediction-wise. (There are others, including most notably Joseph Stiglitz).

– In 2005 Krugman predicted the housing bubble (I lost the link, but it’s on his section of the Times web site)/

– He predicted that the Obama stimulus would save, but not substantially revive the economy, which was correct (ditto that link)

–He predicted that the conservative fears that the stimulus would cause inflation were wrong, and he was correct, as he reminds us in about every column he writes.

-He predicted that that the European austerity program would only sink Europe more and more into recession, which was correct.

Now he says the deficit is not that big of a deal in the short and medium term, and that it is too early to attempt to deal with the long term impacts that are more than ten years out. http://www.nytimes.com/2013/01/18/opinion/krugman-the-dwindling-deficit.html?ref=paulkrugman.

Common sense tells me he is wrong. History tells me he is probably right, because he, not the conservatives or moderate deficit hawks has a history of being right. I trust the guy with the record of being right. I wish Brian, and the great majority of writers who disagree with Krugman would tell me why they, and not the guy with history on his side are correct .

In rereading earlier comments, I see Nate Silver is also down on deficits. I’ll have to check that out. But the the economy, like the NFL, is not like polling and baseball.

Krugman.

The wars and the economy belong to Obama. Come on people, he’s in his second term! The only reason you cling to blaming Bush is because he’s Bush. If Gore had been President on 9/11 and done the same things you wouldn’t blame him. You blame Reagan or Bush 1. Grow up folks. Bush did a lot of harm and Obama multiplied it.

I’m just going to sit back and watch the libs here try to figure the facts out. It’s entertaining so far. Sort of a NIMBY thing, only with spending. Cut the military and get rid if the Army! But DON’T TOUCH the CPB!

Crabby – the wars and the economy belong to all of us. At least the responsibility for getting out of this hole belongs to all of us.

Thanks Brian for the excellent analysis. I particularly appreciate that all your figures were annual figures rather than 10 year “projections” where one must constantly mentally divide by ten to understand the true annual figure. The historical perspective on the percentage of GDP for each broad category shows that there is no easy fix – but a fix there must be. I sure your analysis has a better chance of truly informing the coming debate over the debt ceiling than my Enterprise Commentary in May, 2011 before the last debt ceiling crisis.

The value of an essay like Nate Silver’s is to look at the causes of the problem – not whose fault it is in non-ideology terms. In this case where specifically are the costs going up? (health care and state/local pensions). We either have to figure out how to pay for these increases, figure out how to control them, or cut funding for a lot of other stuff we have spent money on in the past. (Like the military).

I think Paul Krugman has maneuvered himself into risky territory on this issue, as evidenced by his flirtation with the platinum coin idea and by this essay, posted earlier this month.

http://krugman.blogs.nytimes.com/2013/01/10/the-mostly-solved-deficit-problem/

In the blog post, Krugman spins data from the Center on Budget and Policy Priorities to argue that the deficit problem is “mostly solved.”

But in fact, that organization’s data suggests that national debt will continue to surge toward a level around 80% of GDP, will decline slightly to 77% of GDP, then climb again as far as the eye can see.

Krugman sheepishly acknowledges this reality: “True, there are projected problems further down the road, mainly because of the continuing effects of an aging population,” he writes.

But he shrugs off the notion, put forward by the CBPP, that to stabilize American debt at current levels — around 72% of GDP — we need another $1.4 trillion in cuts or new Federal revenue over the next decade.

Krugman’s take on this fiscal reality is glib at best and borders on disingenuous:

“So you heard it here first: while you weren’t looking, and the deficit scolds were doing their scolding, the deficit problem (such as it was) was being mostly solved.”

But finding another $1.4 trillion in deficit reductions — beyond the cuts and tax increases we’ve already seen — won’t be easy or painless.

Until we figure out how to do it, we can hardly say the problem is mostly solved.

–Brian, NCPR

Good points, Brian. It would be unfortunate, and uncharacteristic, if Krugman let his personal ideology trump his heretofore remarkable ability to foresee economic realities.

Well on a very small and slightly pathetic way we made a first tiny step by increasing the social security tax to where it had been for the past 50 years. Those kind of adjustments will be what this is about. Next year we could increase the Medicare/Medicaid tax by 1/2 or even 1% across the board. The year after you reduce Payouts in both those systems by 1/2% and raise the social security retirement age to 68 and so forth.

The issue though is politically being able to cut on of these programs in real terms.

Where Krugman is confounding the critics is in the debt markets. The debt markets are sending a signal that this level of Debt is fine, interest rates are low, inflation is low, bond yields are really low. From that perspective it is a great time to borrow money, which is a good thing since the US borrows so much.

It’s misleading to say that military spending as percentage has remained constant. The wars in Iraq and Afghanistan were been funded off the books, that is, in supplemental and emergency appropriations. Also, substantial military-related expenditures are hidden in other agencies such as Dept of Energy, State Dept, Veterans Affairs, and Dept of Homeland Security.

erb why would you have a war as part of the regular budget? It is not off the books it is accounted for the way any war would be. What do you mean “hidden” in those other agencies? That is all a matter of public record?

“In the blog post, Krugman spins data from the Center on Budget and Policy Priorities to argue that the deficit problem is “mostly solved.””

True or not (NOT) the markets disagree with Mr. Krugman.

The markets need to see serious efforts to curb the bebt. They are optimistically waiting for it right now. If it doesn’t come soon the president will not have as pretty legacy.

Paul do you mean you believe that without serious action on cutting spending within the next 6 months-1 year we are looking at a spike in our borrowing costs?

To me just in the big picture the bond markets seem to be agreeing with Krugman’s assessment that our debt simply is not that big of a deal? Am I missing something?

“The markets need to see serious efforts to curb the debt.”

The markets need to see business activity increase. It’s weak demand that is holding the markets back. Otherwise, you’d think the market would have reacted favorably to the Republicans holding the debt ceiling hostage– the markets should have been thinking “at last someone is taking the deficit seriously.”

But unlike deficit hawks everywhere, the markets don’t seem to care much about debt. They want to see a recovery, and as austerity scolds around the globe have found the last couple of years, austerity does not have good record at spurring recoveries.

Who runs this country? Washington or Wall Street and the banks?

The bond market is happy – the stock market is sort of happy – profits are up. The stock market would be happier if the congress learned to tie its shoes or learned to either walk or chew gum (let alone do both at the same time).

@Paul – What I meant by expenditures being hidden in other agencies is that that money isn’t seen as military spending when in fact that is its purpose.

Pete, if you saw the PBS Frontline special on Obama’s first 4 years, you would know, if you didn’t already, that for at least the first two years of the last four, Wall Street and the big banks ran both Washington and the country, through Treasury Secretary Tim Geithtner (Turns out I was wrong to blame Summers for Obama’s cave to the banks. He, like Axelrod and some others argued for Obama to come down hard on the big banks and their fraudster CEOs. ) Geithner convinced Obama not to press the oligarchs because they might panic and fail to contribute to the recovery. Obama did as told, the bankers took our bailout money, gratefully gave themselves $13 billion in bonuses with it, and failed to contribute to the recovery anyway.

Public employee pensions continue to be a time bomb, at least for state and local government. Many of these plans – particularly for law enforcement and other first responders – are supposedly modeled after military pensions: do 20 years and go home with at least half your base pay. In the last twenty years, however, the military pension system was overhauled radically to make it 40% of base pay, and base pay has become an ever smaller portion of the active duty force’s pay stub (house, food and other tax free allowances have increased generously but are not included in retirement calculations). Some state and local pensions require no employee contribution at all, like the military; and others require employee contribution at the outset but waive it in later years. And finally, state and local pensions are set up to be “gamed” by folks puffing their pensions sky-high by getting ridiculous overtime in their last three years of work, with a wink from their supervisors. NY is a prime example of this and reform is well past due. Nobody needs to be paid $300,000 a year in retirement – it’s obscene.

Well as far as “running” the country, given our country borrows around 40 cents for every 1 dollar we spend, we could not continue on as we are now, without the permission of those we are borrowing from. So there is no doubt about it that we as a nation are in many ways run by the bond markets or at least they have a major vote in how we operate as a nation.

Interest payments on our current debt is the 6th largest component of the Federal budget. It is twice as big as all of our spending on infrastructure for example, which shows the problem of running a huge deficit. Now consider what happens to that percentage when and if interest rates jump on our debt? We won’t have a bunch of policy choices to make we will simply use our taxes to pay off our debt and whatever is left will be fought over. This is the future without change.

Mervel-

The neither the bond markets nor the Chinese are running the country. They loan us money because we are, in their opinion, the best and safest place to put it. I am unaware of any policy decisions made to please markets, except the very sensible ones of not going over the budget cliff or defaulting on our debts (assuming the latter).

Krugman, I’m, pretty sure, would argue that a big part of the debt problem would be resolved had reasonable revenue increases been coupled with a stronger stimulus to increase consumer demand. Pump more money into the economy for infrastructure rebuilding (which few argue needs to be done) and the restoration of public service jobs , and the jobs and profits thereby created would have (assuming it’s too late now) created more taxpayers, who, though the multiplier effect create still more taxpayers, paying more income taxes, and more than offsetting the initial government outlay. This seems to be how the New Deal at least ameliorated the Great Depression, and unarguably finished it off with massive taxing and borrowing during that mother of all stimulus programs, the prosecution of WWII.

Whether that would have worked this time, I do not know, and neither will anyone else. For reasons well-known, the time to try to do so is now behind us.

“…given our country borrows around 40 cents for every 1 dollar we spend, we could not continue on as we are now, without the permission of those we are borrowing from.”

How does that work? Can your mortgage bank tell you how much you should spend on groceries?

The real reason Wall St. runs the country is because they fund the re-election campaigns of too many politicians, and/or they have lucrative positions waiting for them as lobbyists when their terms are done. We need to shut the revolving door. And we need redistricting reform. And we need filibuster reform. And we need to rein in the military/industrial/congressional complex (the term Eisenhower originally used– he changed it out of fear of offending Congress).

Walker I think the revolving door is certainly part of it, I noticed even in President Obama’s plan for tax increases last year, the increased rates did not fully impact carried interest for Investment Bankers, so once again Wall Street was protected.

But on a broader scale here is how it works as far as our debt goes. Your mortgage bank can certainly tell you how much to spend on groceries, the amount you have to spend on groceries is how much you have left after paying your mortgage. US debt needs to be refinanced every other month or so as we need to borrow more and more, if the Bond markets don’t believe we are a good credit risk they will not bid on our debt until they get a better price, that means the interest we pay on our debt would go up; that means there is less to spend on things like social security, roads bridges etc, in that sense they are dictating what we have to spend. Even now the interest payments we are making is replacing many other good things we could be doing, things like education, roads, bridges etc, those things are all smaller than what we spend on interest on our debt.

Newt,

We need to borrow money to run our country right now that means we are indeed beholden to these markets at some level. Now as you point out right now the signal being sent is yeah you are a great credit risk.

WWII is no longer the mother of all stimulus programs, in real terms we are now spending and borrowing as much as we did in WWII. So what are we getting for it?

This is a proud to be an American day. Thank you Obama and MLK.

“Otherwise, you’d think the market would have reacted favorably to the Republicans holding the debt ceiling hostage– the markets should have been thinking “at last someone is taking the deficit seriously.””

Walker the markets are not going to react favorably to having the can kicked three months down the road. I am talking about serious stuff like the business roundtable just unanimously called for.

What did they call for?

Mervel- We get to pay off all the wonderful stimulus we got for out of the Iraq and Afghanistan Wars. Blowing those countries up, and then rebuilding them so their inhabitants could blow them up again, and rehab for our wounded vets.

Yeah that is true.

But I would like to see a breakdown, I know the wars were of course extremely expensive. However this years deficit (not the debt), would include zero Iraq war spending and a reduced Afghanistan war spending. Yet the Defense appropriations are as high as ever and our overall spending is higher than it was when we were in Iraq. So what is going on? If the Iraq war so sooo expensive did we just take that money that we were spending in Iraq and buy more f-22’s or pay more medicare or what? We should have seen a net reduction somewhere.

“US debt needs to be refinanced every other month or so as we need to borrow more and more, if the Bond markets don’t believe we are a good credit risk they will not bid on our debt until they get a better price, that means the interest we pay on our debt would go up; that means there is less to spend on things like social security, roads bridges etc, in that sense they are dictating what we have to spend.”

Yes, if they didn’t think we were a good risk, rates would rise. But they haven’t. They’re at historic lows. Conservatives have been hyperventilating about the debt since Obama took office, and the only time the rates went up is when Republicans had their hissy fit playing chicken over raising the debt ceiling.

Walker, sorry I misread your comment above. Like I said the markets have been optimistically waiting. They have been reacting somewhat positively to the chance that something is going to be done (and on other positive signs in the economy). There is clear consensus in the business community that the debt must be dealt with soon and seriously. What Brian writes here is true. Something must be done. I don’t expect to see much over the next 4 years. We will have to see what happens. If the ratings agencies continue to lower our ratings we will be viewed as a risk and the bottom could fall out of the tub. That is why investors continue to sit on cash and some are moving large amounts of assets into cash or cash equivalents.

Mervel, yes, I think that the markets want to see movement in the next year. Once you get to the point where folks have gotten back much of their recession losses they will get very bearish if the economy is still sour. Add to that money printed by the fed getting into circulation and interest rates will start to rise. Then bonds will become attractive and that will furthur drain money out of the equity markets. Large investment firms are already starting to make these adjustments. Even Warren Buffet is already making the switch to cash.

You are correct Walker.

But the other point I was making even at these very low rates, just making our debt payments every year is the 6th largest component of our federal spending. Our interest payments on our debt every year are TWICE as large as all of the money that the federal government spends on all of our highways, all of our bridges all of our airports, ALL infrastructure each year.

So if we look around at our crumbling society and infrastructure it is hard to say that the debt has had no impact.

The markets don’t care if the US is crap or not, as long as we make our debt payments and we will do that and that is why we get the low rates. But this debt is crowding out our ability to do other things with our money.

And yet 8 years after the collapse not one big banker, not one big bank; among a group of men and banks who perpetrated one of the nations biggest frauds, that made Madhoff look like an boy scout; that caused this massive recession has been prosecuted. Many are still in charge when they should be in jail, there is a reason that Wall Street supported Obama, it was a get out of jail for free card.