Sorry, Dems. The problem really is entitlement spending.

President Barack Obama just destroyed the Republican Party for its fickle, muddled and ultimately incoherent stand on the fiscal cliff.

It’s likely that the White House will make the GOP look stupid, weak or worse yet, radical again over the debt ceiling.

In the midst of a fragile global economic recovery, no one with a lick of common sense wants the United States of America to default on its debts.

The weird thing about these Democratic victories is that, in broad terms, Republicans and conservatives are in the right.

Our fundamental fiscal problem really is out of control spending on social programs, and not taxation or the size of the US military.

Here are the basic facts.

Through post-War American history, tax receipts to the US treasury and total Federal spending have remained fairly stable, floating between 15% and 20% of GDP.

From the Great Society years through the era of Newt Gingrich and the Republican renaissance — and despite all the ideological debates — government remained remarkably stable in size.

That’s according to figures compiled by the White House itself.

Yes, the Bush tax cuts pushed us from the higher end of that scale (around 20.6% of GDP) down toward the middle of that scale (taxation around 17.6% of GDP).

Which was problematic, given that President George W. Bush exploded spending, boosting entitlements and launching a couple of wars that he had no practical way to pay for.

And yes, the Obama tax cuts — passed as part of the controversial stimulus — helped push revenue even lower, down to around 15.1% of GDP.

This at a time when he too blew up spending, paying for a vast array of programs designed to keep the domestic economy from tanking.

But it’s important to note that taxation, even through this hardscrabble period, remained in the range that was recognizably “normal.”

By the White House’s numbers, however, Federal spending has now ballooned to well over 24% of GDP. That’s far outside what you might describe as the “social contract” range for America’s post-war society.

Indeed, Federal spending hasn’t been this high, as a percentage of GDP, since 1946. When you factor in state and local government spending, the public sector’s role in our economy has reached levels not seen since World War 2.

Which is a problem. Even if we bring taxation back up to the historic high-end level of around 20% of GDP, America will face deficits of between 2% and 4% of our entire economy into the foreseeable future.

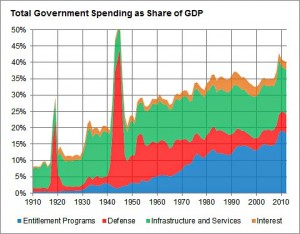

Nate Silver’s graph captures the rise of entitlement spending in American government. It now comprises one in five dollars spent on government. (Source: NYT)

That is — in layman’s terms — a massive and unsustainable level of debt-building. It just won’t work.

Liberals have tried to argue that the debt problem is a short-term crisis caused by low Bush-era taxation and a bubble of stimulus spending.

The economy will recover, more people will go back to work, the ship will right itself — especially if we just boost taxes a bit to close the gap.

Unfortunately, the numbers say otherwise.

Nate Silver, the esteemed New York Times statistician, just published a devastating essay showing the rapid and long-term increase in spending on entitlement programs.

He points out that when you include local and state spending, social entitlement and welfare programs already represent nearly 20% of GDP.

“Spending on entitlement programs was about $500 billion per year in 1972 in today’s dollars,” Silver writes.

“If it had increased at the same rate as the gross domestic product, it would now be about $1.4 trillion. Instead, it is now about $2.9 trillion per year. What this means is that there has been about a $1.5 trillion increase in entitlement spending above and beyond gross domestic product growth.”

In other words, every single year since 1972, we’ve added roughly $38 billion to the cost of entitlement programs, again and again and again, and that’s beyond the rate of inflation. With our aging population, that number is only expected to grow.

By way of contrast, military spending, as a percentage of GDP, has been stable or declining for decades.

So why aren’t Republicans winning this fight? Several reasons.

First, they haven’t confronted their own history. Yes, Barack Obama’s stimulus spending ballooned government spending as a share of GDP. But George W. Bush was no piker.

He added $900 billion worth of red ink during the final year of his presidency alone.

The GOP has also resisted even modest calls to cut the size of the US military, despite the fact that we’re winding down two wars, are in something akin to peace time and currently spend more on defense than the next ten nations in the world combined.

Meanwhile, Republicans continue to lavish attention on symbolic budget cutting gestures — public broadcasting, Planned Parenthood, etc. — and on ludicrous proposals that tax revenues be cut even further.

This posture has made it all but impossible for conservatives to propose the kind of serious, credible and (yes) painful budgets that would bring social spending back into line with historic norms.

I suspect Republicans could regain the high ground very quickly.

First by arguing for comprehensive tax reform –simplifying the system, closing loopholes, modest and targeted tax rate hikes, etc. — that would bring overall Federal revenues back to roughly 19% of GDP.

That’s the level we saw during the first three years of Ronald Reagan’s presidency.

Second, by pushing for balanced spending reductions that phase in cuts of roughly 1% of GDP per year, bringing Federal spending down to about 19% of GDP by 2018.

A serious proposal of this kind would mean abandoning Ayn Randian fantasies about returning the public sector to the role it held prior to the New Deal. (In the early 1930s, Federal spending was only about 3% of GDP.)

But a credible budget balancing plan would also force Democrats to engage with a real and credible set of fiscal arguments about the limitations of government.

The days where Barack Obama could shadow box with tea partiers in Ben Franklin costumes would be over.

By phasing the cuts in slowly, we would also avoid the kind of “austerity cliff” that has crippled the recovery in parts of Europe.

As a final note, it’s an open question whether Democrats in Washington might try to grapple with some of these fiscal realities on their own.

I know conservatives are deeply skeptical about this. But California’s Democratic governor, Jerry Brown, worked with a Democratic legislature to rein in his state’s fiscal crisis — through big tax hikes but also through massive cuts to social spending.

That state is now expected to post significant surpluses.

And New York’s Democratic governor, Andrew Cuomo has done much the same, taking on public sector unions over wages and benefits, curtailing pension costs, capping local property taxes, and adopting something resembling fiscal discipline.

Is it possible that President Obama, in his second term, might lay out a plan that would follow this Democratic model, stabilizing America’s long-term fiscal health?

We may get our first answers to that question when Mr. Obama gives his second inaugural address on Monday.

Tags: government, spending

Here is an example of what I am talking about. Savy investors make these moves and others follow suit. Maybe they want the funds for a big buy but maybe not:

http://finance.yahoo.com/news/buffetts-berkshire-slashes-stock-holdings-204257365.html

The little guys try and stay in as long as they can.

OK, yes, we need to do something about the deficit. But it is far more important that we get the economy moving first. Attempting to rein in spending before the recovery is secure simply takes money out of paychecks, reducing consumer spending, which stiffles business spending. That’s what stalled the recovery in ’37.

First things first.

Liberals have been saying for a long time that there are structural problems with entitlement spending. Liberals have been offering solutions to those problems for a long time. How do you control the rapid escalation in healthcare spending? Single-payer. Yes it would bring more spending into the government sector but in the long run it would stabilize the escalation in costs vs GDP. Why do we want deficit spending during a recession to keep more people at work in schools, police, highway maintenance, etc? Because those people would be contributing to GDP while they are working but not at all when they are unemployed and while unemployed they are part of escalating costs for entitlements.

I could go on but I won’t because liberals know what I’m talking about and people who like to demonize liberal opinion won’t listen.

“…interest rates will start to rise.”

Yeah, they’re bound to. Some day.

How long have conservatives been saying they were just about to start going through the roof?

“First things first.” No doubt we will probably get the opportunity to see if this works. There is no indication that the deficit will be improved so let’s see what happens. I personally plan to continue to be very “conservative” in my spending and investing. I am no Warren Buffet, but I agree the signs are not good.

Demographics don’t lie. Ignoring that is like ignoring the few economists that told us what was coming back in 2007.

Walker on you 906 comment as we all know we are talking about historic lows so again let’s see what happens.

Knuck, single payer may be one solution to consider but it has almost no support from either republicans or democrats so why bother talking about fringe ideas? Focus man, focus!

Paul, list of “fringe ideas”:

abolition of slavery, women’s suffrage, interracial marriage, gay marriage, global warming, single payer health care.

Such a “fringe” idea that Norway started doing it in 1912, Japan in 1938, United Kingdom in 1948, in fact about a score of countries have single-payer and more have a variant such as two-tier health insurance.

The real Fringe are the people who wont even open their minds to discussing a real and viable option.

How about this for fringe, the people of the richest nation in the history of the planet (depending on how you look at it) would rather argue about whether we have enough guns and bullets than spend some money to make sure everyone has access to health care.

What is the easiest way to increase GDP? Get the people who are at the lowest productivity levels to become a lot more productive. How do you do that? Make sure they are healthy, well educated and employed.

How do you fix the structural problems of cost vs GDP? Get the people who are at the lowest productivity level to become a lot more productive.

How do you slow the escalation of entitlement spending effectively? Work on the problems of the fastest growing segments of entitlement spending.

Hey, does anyone remember the infamous Death Panels? What was that about? According to Wikipedia a section of the health care bill “would have paid physicians for providing voluntary counseling to Medicare patients about living wills, advance directives, and end-of-life care options.”

Why would you do that? Because often the most expensive treatments a person ever receives are at the end of their life — and often people dont plan for their own death leaving their families to make decisions for them that may be extremely expensive while at the same time not improving the day to day quality of life.

Fringe indeed!

Knuckle,

I agree we need to help change some of these structural issues and that means investing in education and health care. The issue is that our actual debt is now making it harder to do that as more and more of our spending is becoming non-discretionary. We have to make our debt payments, unless we change the formulas we have to pay medicare and social security, as those balloon we have less and less left to do any of those things you mentioned. Entitlement spending does not go to help keep people employed or if your under 65 in health insurance. In fact it does not even go to lower income individuals. It is a ran away train at this point that no one seems to know how to stop or has the will to stop, including Republicans. Republicans had a chance to reduce spending they kept on spending so all hands are in this together, which is why I doubt we will ever voluntarily cut entitlement spending.

Yesterday, I listened to an analyst who mentioned Obama hoping for a “peace dividend” as these wars wind down…. When was the last time we heard of such a thing? I believe it was during the Reagan administration, and I believe there was going to be a great dividend after winding down the cold war. I don’t remember that ever really happening. The cold war exhausted the entire treasure of two nations, and ultimately achieved nothing for all that expense.

The Middle-East wars have done the same, spending every available dollar (and every borrowable dime) to achieve nothing. We’d have had a better return if we’d sent the jihadists all bus tickets to Disneyland.

“Death Panels” are the logical remedy to the current system in which an ancient patient with only days to live can be given a new $100,000 treatment that will extend their life by…days. If the patient has the right kind of insurance, the hospital can leverage that to build a new wing. Sometimes it about saving lives, but sometimes it’s about maximizing profit.

Mervel, liberals have been offering simple fixes for Social Security for a very long time and let’s all remember that Social Security is still funding itself so it isnt an immediate problem on our national balance sheet – in fact Social Security money has been used for a long time to shore up the balance sheet.

Medicare and Medicaid, as liberals have been saying for at least a decade, is the real problem on the entitlement front. Resolving the problems of M&M wont be easy but we are a country that can do a lot of things that arent easy. As they used to say “we can send a man to the moon.” I go to meetings of liberals, I have heard the discussions. Liberals are worried about our debt problems; liberals have been working on solutions to the debt problems; and liberals are willing to compromise on the solutions.

Now, what do we hear from the Party of No side?

And there is no doubt that there needs to be pension reform of some kind, but we also need to keep the promises we have made to people in the past. And we need to ensure a society that offers a good quality of life for retirees. I am not prepared to accept a society in which a small number of people live better than Charelmagne while the masses of people struggle to get by on Social Security.

What we will need to do is to explore some fringe ideas in order to resolve some of those problems. I have a sister and brother in law who retired from the state on pretty nice pensions in their mid-50’s. they could live for 30 or 40 years in retirement. They are bright and healthy people, how do we find ways to use their energy and skill to increase GDP without taking away benefits they EARNED? And how do we do that without taking jobs away from people who need work? If we can solve that problem alone we may have a solution to the couple of percent difference in GDP vs govt spending.

Newt, re your 3:11 post- What you are arguing for is trickle down economics, only using taxpayer money instead of tax cuts. That’s all a “stimulus” is- trickle down economics. If taking borrowed money and “investing it” in that way is a good idea, why are tax cuts across the board a bad idea? The logic isn’t there.

Just wondering if you’d thought of it in those terms.

mervel says:

January 21, 2013 at 8:48 pm

And yet 8 years after the collapse not one big banker, not one big bank; among a group of men and banks who perpetrated one of the nations biggest frauds, that made Madhoff look like an boy scout; that caused this massive recession has been prosecuted. Many are still in charge when they should be in jail, there is a reason that Wall Street supported Obama, it was a get out of jail for free card.

Excellent point Mervel, but you missed assigning blame to the politicians that fostered the whole mess. We need to start making our political hacks accountable. They aren’t now. The only ones not still playing the game are those that have died. The rest are still hard at it.

Walker says:

January 21, 2013 at 8:56 pm

“OK, yes, we need to do something about the deficit. But it is far more important that we get the economy moving first. Attempting to rein in spending before the recovery is secure simply takes money out of paychecks, reducing consumer spending, which stiffles business spending. That’s what stalled the recovery in ’37.”

Walker, go back and re-read your history. What stalled the recovery in 37 was micro management by FDR and his cronies. When businesses wanted to re0nvest in their infrastructure they were instead forced to hire workers they couldn’t use, things like that.

You are right in one sense. You stated in another post that the markets need to see business moving before they start spending their money. Business is waiting too, waiting to see if it’s safe to stick their necks out. What we have now, and have had for quite some time, is an environment where success is punished, where investment and growth are viewed as harmful somehow and where profit is evil. Until the WH and Congress work to foster a climate where business is properly viewed as an asset things aren’t going to grow. “You didn’t build that!” is the type of thinking that hurts investment and growth.

Knuckle, here’s the problem with singe payer in one conservatives view- first off it’s handing 1/5 of our economy off to the gov’t to manage. The same gov’t that has a dismal track record in almost every other area. Taking the healthcare that so many of us have planned, worked and paid for for years and suddenly handing it over to some .gov bureaucrat involves an substantial amount of risk to those of us that took responsibility for ourselves already. 2nd, what would that do to the economy? You want to essentially pull the rug out from under the medical industry. That didn’t work too well for all those GM bondholders and it won’t work out for the medical industry either. It might well result in large scale losses and a major upheaval to the markets. 3rd, in all those other nations with socialized healthcare, the gov’t owns or controls the vast majority of the hospitals, pharmaceutical plants, employs the doctors and nurses, etc. Comparing us with Sweden or Japan is not apples and oranges, it’s more like apples and tires.

A agree that in one sense it would likely bring down costs tot he gov’t, but at what price? You trade one HMO off for another and you have no option to switch providers. That’s an answer?

As Brian points out, entitlement and social program spending excesses are at the heart of our financial problems. I suspect we don’t see effective leadership from Obama and the Democrats because it would require an admission on their part that their core philosophy (the government can spend its way out of any problem) is flawed and has been a large part of the problem. That’s why it’s always about what Republicans and conservatives should do. That’s why there’s so much talk and so little substantive action. That’s why the focus is always on higher taxes and not lower spending. It’s time for Democrats to take a long, hard look at themselves.

Knuckle, your 8:16 post- You mention people struggling to get by on SS. Isn’t the first step getting people to understand that SS isn’t a retirement program? Seriously, I know people that thought they were supposed to “retire” on their social security payment. You talk about educating the poor, this is where you start. Personal responsibility in all things including healthcare and retirement. Your inlaws that retired form the state, good for them! They planned it out. Chances are they didn’t make a mint and started out making peanuts. They WORKED and fulfilled their obligations, payed taxes and probably still pay taxes on everything but a portion of their pension. If they’re like most of us they went onto other jobs in the private sector where they pay more taxes. Which is better, that scenario or the 80 million people that have simply stopped looking for work? Jeeze, Obamacare was passed to provide healthcare for the alleged 47 million people who didn’t have health coverage but we have over 80 million not even trying to find a job! Seems to me we have our priorities backwards. If we’d put the 80 million to work I bet we wouldn’t have “needed” Obamacare at all! Instead of offering people a hand up to where they could take care of themselves we gave them a boot down onto public assistance. Great idea.

Brian may point it out, but that don’t make it so. Last I looked, Brian doesn’t have a Nobel Prize in Economics. Krugman does, and he disagrees with Brian’s contention.

And I’d say the election means that it’s time for Republicans to take a long, hard look at themselves.

Krugman himself, in an NPR interview

http://www.forbes.com/sites/investor/2012/09/19/which-nobel-economists-are-idiots/

indicated that some Nobel prize-winning economists are “idiots”. How’s that platinum coin thing working out?

The Republicans lost the Presidential election, were “destroyed” and made to look “stupid” and “weak” by Obama. The Democrats won the popularity contest, now they need to GOVERN.

They might be able to if House Republicans would give them half a chance instead of obstructing at all costs.

“Krugman himself, in an NPR interview indicated that some Nobel prize-winning economists are ‘idiots’.”

Ah you mean on that well known, hard news interview show, “Wait, Wait…Don’t Tell Me!” Yeah, I’m sure he wasn’t just kidding around.

“Republicans … were … made to look “stupid” and “weak” by Obama.”

I don’t think Obama had anything to do with making them look weak and stupid. They did that all by themselves.

Guys don’t have a conniption over the term “fringe”. What I meant is that there are very few people here in the US that want to consider the single payer option. So we can continue to discuss it but it can also be a distraction when almost nobody cares to go in that direction (despite all the other countries that you mentioned).

It doesn’t mean it is a bad idea it is just an idea that will not fly here in this country.

He said it; I didn’t. In any case, the Nobel Prize (and the economics prize is actually not a “Nobel Prize”) is rather like the Baseball Hall of Fame: a prestigious but subjective award, open to debate.

There are many Nobel prize winning economists who really disagree with Krugman, particularly out of Chicago.

There is not a consistent opinion among Nobel prize winning economists on this situation. Krugman is very good at translating a sound economic thinking into layman and political terms, even when I disagree with him I think he has done macro-economics a great service by getting people interested in it.

OK, Walker, have you trashed Republicans enough? Can we get to the substantive part of my comments: Democrats can’t lead effectively because they will not admit that their core philosophy is a major part of the problem.

” Democrats can’t lead effectively because they will not admit that their core philosophy is a major part of the problem.”

Larry, if you substitute “Republicans” for “Democrats” in your statement, I think a slight majority of the people would agree with it.

Crabtree- In my 3:11 comment I absolutely stated that stimulus programs deliberately in the new Deal and as a byproduct of the WWII effort worked. They were not tricke-down, since the money borrowed by the government, while certainly adding to corporate profits and salaries to build dams, roads, schools, bombers, submarines, the A-bpmb, etc., etc., mostly went into the salaries of the workers who built them, paid taxes, and spent their earnings and thereby created more jobs. I frankly can’t imagine how an economy 60% devoted, as it was 1940-44, to building weapons of destruction, not means of production (dams, etc, as in the ’30s), could drag the country not only out of the Great Depression in a sustained way that sustained prosperity through the ’50 and 60’s, but it did. The post-war recession was mild and short. The massive debts we acquired to fight the war were not rapidly paid off, but they did not hinder this growth. This is not trickle down.

Per your response to Walker on the New Deal, there was a steady reduction in unemployment and growth in GDP from the One Hundred Days through August on 1937, when because of a combination of cutbacks in govt, taken by FDR undertook at the urging of his more conservative cabinet members (esp. Treasury Secretary Rbt. Morgenthau, the Tim Geithner of his day, apparently), and the drop in disposable income resulting from the onset of Social Security Taxes, the economy dropped even more than in’29. So, , the ’37 crash was apparently caused by both a cut in spending, and new (if unavoidable, if we were to have Social Security) taxes. I suspect that FDRs attempted micro-management of the economy under the NRA may have played a part, also, but my source (George Tindall, “America, A narrative History,” 1988) does not allege this.

So both declining government spending and new taxes caused the crash of ’37. That should make everybody happy.

But the boom of 1940-74 came right out of FDR’s war effort, taxing, borrowing, and all.

Per my above, a good book about the economic impact of the WWII was effort is Arthur Herrman’s “Freedom’s Forge”. 2012. Herrman was a fellow at the Heritage Foundation, and no lover of FDR, New Dealers (always getting in the way of the heroic Captains of Industry), or unions (ditto). You get the impression from him that we would have won the war quicker and cheaper if the government had just stayed the hell out altogether. So you conservatives should enjoy it. But the book does tell a fascinating story.

Just because the guy has a Nobel Prize for his work on international trade does not make him the “be all end all” of economics.

We don’t expect someone who wins a Nobel Prize in medicine in one field to run around telling us they have the answer to all the problems that come up in all the other fields of medicine.

His opinion is important, but it is just that, his opinion. We just hear his opinion a lot since he is using it to make money in so many different venues. If a Nobel laureate in some of the other fields were to act that way they would probably take back the prize.

You would think that with a Nobel Peace Prize winner at the helm we would not have so much chaos in the world??

paul is right. people shouldn’t listen to krugman because he has a nobel.

we should listen to krugman because he’s almost always right! i mean, seriously, his track record as a pundit is sterling. you go against him at your peril.

Walker,

When the Republicans regain power they will be fair game for your comments. Until then, the questions about the failure of current leadership concern the Democrats.

Newt, try Amity Shlaes, “The Forgotten Man” for a more critical look at FDRs micro management and bungling efforts at making himself a King. He was a terrific leader but a terribly flawed leader with some truly harmful ideas that did us no good. And I would argue that FDRs precedent caused most of our problems post WW2 rather than contributing to our success. I suppose it depends on your viewpoint. But even in those times his policies were seen to be affecting the work ethics of people, and not in a good way.

I have to wonder about the inclusion of SS taxes in the 37 crash. If I read the charts correctly it was a 1% tax at the time, clear into the 50’s. I can’t see that having a big effect. I think this link will give you some interesting ideas to mull over- http://newsroom.ucla.edu/portal/ucla/FDR-s-Policies-Prolonged-Depression-5409.aspx FDRs wage hikes and other practices, like giving a lot pf power to John L Lewis and the unions hamstrung many businesses. It all fell in place in 37 and took about 18 months to sort out. More money wasn’t the answer and neither was more micro management. In way it was similar to today where those with money are taking a wait and see attitude, the gov’t is doing nothing to encourage them to invest and build.

So, have you considered that a stimulus is just trickle down economics or do you reject that idea entirely?

“Just because the guy has a Nobel Prize for his work on international trade does not make him the “be all end all” of economics.”

No, Paul, of course not. But if I have to chose between Brian Mann’s take on the economy, all else equal, I’ll pick the opinion of the guy with the best credentials. (No offense meant to Mr. Mann).

(‘specially if he agrees with me.)

Speaking of credentials: “Amity Shlaes graduated from Yale University magna cum laude with a bachelor’s degree in English in 1982.” (Wikipedia)

I’m not seeing anything else, although she has served on some prestigious right-wing think tanks.

Here’s Krugman’s take on her: Amity Shlaes strikes again.

“When the Republicans regain power they will be fair game for your comments. Until then, the questions about the failure of current leadership concern the Democrats.”

So if Republican is elected with Democrats controlling the House, and they stymie every initiative, you won’t feel free to complain about it?

“…the economics prize is actually not a “Nobel Prize”) is rather like the Baseball Hall of Fame: a prestigious but subjective award, open to debate.”

Krugman’s prescriptions for the great recession have not been that accurate. Some economists felt that we should have let the banks fail as they essentially did in Iceland (and also prosecute the criminal fraud committed by the banks, I realize a smaller scale possibly not relevant), but the thinking was that we would have recovered faster by doing that for a variety of reasons. Now we are stuck with the same too big to fail system; in some ways we are even more beholden to the banking conglomerates than we were before the crash.

The main thing he has been correct on is interest rates and the fact that we really are in a classic liquidity trap. Several other people were predicting the meltdown. But macro-economics is certainly a very flawed field in general. The smart economists in general know that they cannot make accurate predictions about the economy.

The debt has not caused a systemic collapse of the US economy either which some people were predicting back when Obama was proposing the stimulus, Krugman was correct about that also.

There should not be any income limit on the SS tax but the share for the employer should end at $150,000.

The Medicare tax should go up from the current 1.45% to 2.45%.

All incomes,without regard to type or source of income, should be subject to theses taxes.

These simple measures should fix the so called entitlement problems.

When the Republicans regain power? Very unlikely as long as they continue to hate women, gays, just about anyone who isn’t rich and continue to be bought and paid for by the NRA.

Oh, forgot one big one. They also need to stop plotting to get us into another war.

Crabtree-

Per Walker, Krugman has spoken regarding Amity Shales. Case closed.

I will look at “The Common Man”.

I read the UCLA article some time ago. Check out this response.http://www.salon.com/2009/01/02/sirota_fdr_depression/.

The facts are that the economy crashed and burned after after tightfisted Republican domiance 1920-29, and only got worse between 10/29 and 3/33, after which it recovered under the big spending New Dealers, imperfect and error-prone as they were. Those who were there certainly believed this to

be the case. WWII tax, borrow, and spend policies, and their results, proves the case.

“Trickle down” to me means loading up the wealthy and corporations with and hoping some of this will trickle down to the average person. I don’t understand why you would call building dams or aircraft carriers, designed to both create jobs and serve a necessary purpose at the time to be trickle down. Bush’s tax cuts were trickle down.

RC, on Social Security; it may not be optimal that SS is all many people have to live on but the fact is that for many people SS is all they’ve got. If you prepared well for retirement good for you, but for those millions who can’t get by without their SS there are probably nearly the same number of stories of why they don’t have enough retirement to live on. Maybe It was poor planning, maybe it was just bad luck. How does it do you any good to pass judgement on them? What should we do, put those people out an an ice floe?

Mervel-

I know Krugman prescribed 2X the finalized stimulus, and he says that was riddled with tax and regulation cutting bones thrown to the Republicans in a futile attempt to get their support. Hard to say programs did not work when they were less than 1/2 tried.

I’m not going to try to find articles, but I’m pretty sure he never supported “too big too fail”. Anything but.

Pete Klein-

Those look like reasonable ideas for SS and Medicare, though certainly not out of the AARP Bible, which all liberals are supposed to obey without question. Can you source why they should work?

I understand that Single Payer is philosophically anathema to conservatives. I’m not looking at it in philosophical terms, I look at it as a practical solution.

As for putting medical companies out of business I would suggest that the US government being the primary customer for military contractors hasn’t put them all out of business.

As I write this I am supposed to be making a decision on my company health care plan for next year. My insurance company has raised the rate for my plan 15.9% for next year. It’s an HMO plan which a few years back all the insurance companies were saying was the newest and bestest thing and would save all kinds of money. Now they are telling me that the plan I’m in is a “rich” plan and that “everyone is getting out of HMO plans. They’re dinosaurs.” PPO’s are the new thing. Or high deductible blah bitty blah plans. I don’t have the time or the ability to research and understand all the “options” that are available to me and I have begun to think that the private market cares less about providing the service and more about simply taking my money and hoping that if anything happens to me I die quickly so they don’t have to pay any money out.

I actually am with you on that to some degree knuckle. The US government already pays for over 1/2 of all of the health care used in the US anyway, we don’t have a private system now in any real sense.