Sorry, Dems. The problem really is entitlement spending.

President Barack Obama just destroyed the Republican Party for its fickle, muddled and ultimately incoherent stand on the fiscal cliff.

It’s likely that the White House will make the GOP look stupid, weak or worse yet, radical again over the debt ceiling.

In the midst of a fragile global economic recovery, no one with a lick of common sense wants the United States of America to default on its debts.

The weird thing about these Democratic victories is that, in broad terms, Republicans and conservatives are in the right.

Our fundamental fiscal problem really is out of control spending on social programs, and not taxation or the size of the US military.

Here are the basic facts.

Through post-War American history, tax receipts to the US treasury and total Federal spending have remained fairly stable, floating between 15% and 20% of GDP.

From the Great Society years through the era of Newt Gingrich and the Republican renaissance — and despite all the ideological debates — government remained remarkably stable in size.

That’s according to figures compiled by the White House itself.

Yes, the Bush tax cuts pushed us from the higher end of that scale (around 20.6% of GDP) down toward the middle of that scale (taxation around 17.6% of GDP).

Which was problematic, given that President George W. Bush exploded spending, boosting entitlements and launching a couple of wars that he had no practical way to pay for.

And yes, the Obama tax cuts — passed as part of the controversial stimulus — helped push revenue even lower, down to around 15.1% of GDP.

This at a time when he too blew up spending, paying for a vast array of programs designed to keep the domestic economy from tanking.

But it’s important to note that taxation, even through this hardscrabble period, remained in the range that was recognizably “normal.”

By the White House’s numbers, however, Federal spending has now ballooned to well over 24% of GDP. That’s far outside what you might describe as the “social contract” range for America’s post-war society.

Indeed, Federal spending hasn’t been this high, as a percentage of GDP, since 1946. When you factor in state and local government spending, the public sector’s role in our economy has reached levels not seen since World War 2.

Which is a problem. Even if we bring taxation back up to the historic high-end level of around 20% of GDP, America will face deficits of between 2% and 4% of our entire economy into the foreseeable future.

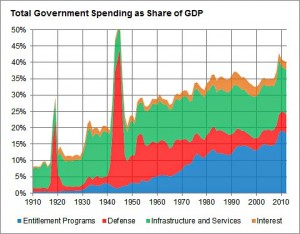

Nate Silver’s graph captures the rise of entitlement spending in American government. It now comprises one in five dollars spent on government. (Source: NYT)

That is — in layman’s terms — a massive and unsustainable level of debt-building. It just won’t work.

Liberals have tried to argue that the debt problem is a short-term crisis caused by low Bush-era taxation and a bubble of stimulus spending.

The economy will recover, more people will go back to work, the ship will right itself — especially if we just boost taxes a bit to close the gap.

Unfortunately, the numbers say otherwise.

Nate Silver, the esteemed New York Times statistician, just published a devastating essay showing the rapid and long-term increase in spending on entitlement programs.

He points out that when you include local and state spending, social entitlement and welfare programs already represent nearly 20% of GDP.

“Spending on entitlement programs was about $500 billion per year in 1972 in today’s dollars,” Silver writes.

“If it had increased at the same rate as the gross domestic product, it would now be about $1.4 trillion. Instead, it is now about $2.9 trillion per year. What this means is that there has been about a $1.5 trillion increase in entitlement spending above and beyond gross domestic product growth.”

In other words, every single year since 1972, we’ve added roughly $38 billion to the cost of entitlement programs, again and again and again, and that’s beyond the rate of inflation. With our aging population, that number is only expected to grow.

By way of contrast, military spending, as a percentage of GDP, has been stable or declining for decades.

So why aren’t Republicans winning this fight? Several reasons.

First, they haven’t confronted their own history. Yes, Barack Obama’s stimulus spending ballooned government spending as a share of GDP. But George W. Bush was no piker.

He added $900 billion worth of red ink during the final year of his presidency alone.

The GOP has also resisted even modest calls to cut the size of the US military, despite the fact that we’re winding down two wars, are in something akin to peace time and currently spend more on defense than the next ten nations in the world combined.

Meanwhile, Republicans continue to lavish attention on symbolic budget cutting gestures — public broadcasting, Planned Parenthood, etc. — and on ludicrous proposals that tax revenues be cut even further.

This posture has made it all but impossible for conservatives to propose the kind of serious, credible and (yes) painful budgets that would bring social spending back into line with historic norms.

I suspect Republicans could regain the high ground very quickly.

First by arguing for comprehensive tax reform –simplifying the system, closing loopholes, modest and targeted tax rate hikes, etc. — that would bring overall Federal revenues back to roughly 19% of GDP.

That’s the level we saw during the first three years of Ronald Reagan’s presidency.

Second, by pushing for balanced spending reductions that phase in cuts of roughly 1% of GDP per year, bringing Federal spending down to about 19% of GDP by 2018.

A serious proposal of this kind would mean abandoning Ayn Randian fantasies about returning the public sector to the role it held prior to the New Deal. (In the early 1930s, Federal spending was only about 3% of GDP.)

But a credible budget balancing plan would also force Democrats to engage with a real and credible set of fiscal arguments about the limitations of government.

The days where Barack Obama could shadow box with tea partiers in Ben Franklin costumes would be over.

By phasing the cuts in slowly, we would also avoid the kind of “austerity cliff” that has crippled the recovery in parts of Europe.

As a final note, it’s an open question whether Democrats in Washington might try to grapple with some of these fiscal realities on their own.

I know conservatives are deeply skeptical about this. But California’s Democratic governor, Jerry Brown, worked with a Democratic legislature to rein in his state’s fiscal crisis — through big tax hikes but also through massive cuts to social spending.

That state is now expected to post significant surpluses.

And New York’s Democratic governor, Andrew Cuomo has done much the same, taking on public sector unions over wages and benefits, curtailing pension costs, capping local property taxes, and adopting something resembling fiscal discipline.

Is it possible that President Obama, in his second term, might lay out a plan that would follow this Democratic model, stabilizing America’s long-term fiscal health?

We may get our first answers to that question when Mr. Obama gives his second inaugural address on Monday.

Tags: government, spending

Okay Thrush, I’ll do it myself. Here’s some stuff to chew on in the meantime.

http://www.psychologytoday.com/blog/homo-consumericus/201206/don-t-romanticize-the-canadian-healthcare-system

http://www.theglobeandmail.com/commentary/the-best-health-care-system-the-numbers-say-otherwise/article5577290/

About 1/3 of Canadians find it necessary to purchase additional health insurance from a private entity. Wait times for service are a major complaint with the notation in one article, “I can’t get an MRI for 6 months for my disease, but I can get one for my dog in less than an hour”.

I think there is more to the story than gross cost.

Krugman’s take on this post…

i find your line of responses really bizarre, rancid. it seems to me your fundamental question is

and it seems to me i’ve answered your question. but i guess there’s a disconnect. so let me try again.

the delivery systems in the u.s. and canada are quite similar. they’re basically private. almost all doctors are in the private sector. prescription drugs in both countries are provided by the private sector and paid for by the private sector (although it should certainly be pointed out that drug prices in canada are regulated — that’s a big reason why pharmaceuticals in canada are cheaper). hospitals in canada (or at least the vast majority of them) aren’t owned or run by the government, but it’s probably not fair to say they’re purely private either; the truth just seems to be complicated.

the links you’ve posted are nice, but they don’t seem all that germane to what we’re talking about. at no point have i said that canadian health care is perfect. i’m sure you can find this aspect or that aspect in which it’s worse than here. if we switched to their system, there would surely be tradeoffs somewhere. none of this detracts from the point that their system is much more efficient.

(not that anyone should care about personal anecdotes, but my and my wife’s experience was definitely that the canadian system is superior. no paperwork!)

I’ve done my reading Thrush and my questions are answered. Canada is not involved in the healthcare system as Sweden and some other nations are. I still question your use of the term “more efficient”. It’s cheaper per capita overall, yes, I agree. But there are so many areas where they differ that I wonder how accurate “more efficient” means. The US has 350% more malpractice suits than Canada. Malpractice insurance runs about $4.00 per year per captia in Canada, about $60.00 in the US. This is where the Tort reform conservatives have spoken of for years would help costs. Yet, people on the left don’t seem to want to consider it. The US spends a lot more on technology than Canada. I suppose that part of the reason the dog get the MRI so much faster! Tha may make things cheaper, but is it more efficient to wait while patients get sicker rather than spend on equipment? Drugs are certainly cheaper overall in Canada, but we if we could bargain price here it would help a bunch. Same for competition among insurance companies across state lines. And then there is the salary difference- US medical professionals make about twice what they do in Canada. That’s why so many of our doctors up here drive cars with Canadian plates! Wait times are far, far longer in Canada overall than in the US. Is that efficient? Of course the US has a much, much higher rate of illegal aliens using medical services and never paying for them outright or with insurance. That adds to the costs.

One thing I was unable to find was any study on the difference in abuse of the system between the two countries and associated costs. Any one who has ever sat in an ER on a Friday or Saturday night, most any night judging by what I’ve seen recently, has seen the people in the ER for what is clearly non-emergency needs. I mean, really, you have a cold or allergies or a rash from poison ivy and you need to go to the ER? It’s free, what do they care? When there is a co-pay or you’re paying out of pocket you might not be in such a rush to obtain unneeded services. Last time I was in the ER was for a dog bite that laid my left bicep open and required 18 stitches to close. We don’t go for headaches, hangnails, hay fever, blood blisters, sun burns, jock itch, athletes foot or for “something to do”. I’ve personally seen people in the ER for these reasons and not a one of them was paying for it out of pocket or through employer insurance. Yeah, all on public assistance. Call me names, but it’s wrong and it drives up prices. I can’t help but wonder if “free” healthcare breeds the same thing in Canada.

Hmmm. Sorry I can’t help you guys on Social Security. I think something should be done. I think we should stop spending social security and return it BACK to the people who are retired. One problem is we don’t make sure people really need the benefits. One idea I have is limiting unemployment benefits to six months UNLESS the person can prove he/she is unable to work. I know I’d give up as many benefits as I could to get our great nation out of debt. Another idea is fixing Medicare and Medicaid so that you need to PROVE you actually need it to actually get it. Who agrees with me about these things?

Robert, common sense ideas never play well with people who run on emotion. Your ideas have been tossed around before, prepare to be skewered and labeled a hate mongering bigoted Tea Bagger.

Welcome to the club.