Teachers Union: Rich districts spend 80% more than poor ones to teach students, tax cap makes it worse

NYSUT graph showing per-pupil spending ranges in New York State. Image: NYSUT press release

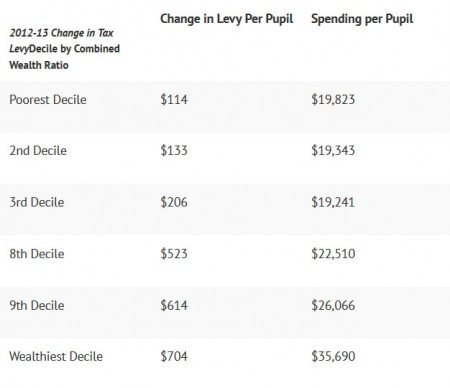

The New York State United Teachers (NYSUT) has today released an analysis (press release, h/t Politics on the Hudson) showing that the wealthiest 10 percent of our state’s school districts spend 80 percent more on teaching students than do the poorest 10 percent, “a funding inequity that is aggravated by the state’s property tax cap and widens the unacceptable achievement gap.”

The NYSUT analysis found that the top 10 percent spent an average of $35,690, compared to $19,823 for the poorest 10 percent last year, although students in poorer communities tend to have much greater educational needs (Much more detail in the press release.)

NYSUT is challenging the tax cap in New York state Supreme Court; that case is set to be heard on Dec. 12. Here’s more on what NYSUT had to say about the tax cap and its impact on students:

“The way New York funds public education is already grossly inequitable, denying the poorest students with the greatest needs the rich array of programs and services they need for success – services more affluent students get every single day,” said NYSUT President Richard C. Iannuzzi. “What the tax cap does, in essence, is to take this grotesque educational inequality and accelerate it even more.”

Iannuzzi said funding inequality and the effects of poverty have a devastating impact on student achievement and graduation rates. He noted that roughly half of New York’s 2.7 million schoolchildren are so poor they qualify for a free- or reduced-priced lunch. New York City has an estimated 50,000 homeless students, and many more homeless youngsters populate shelters and abandoned structures in small cities, the suburbs and rural communities across the state as well.

“Students who are furthest from reaching the state’s higher standards and who are at the greatest risk of dropping out are very often from communities of color or families that live in poverty,” Iannuzzi said. “Instead of investing more to help students in high-needs communities succeed, New York has done the opposite, creating a tax structure that widens the wealth gap and enacting an undemocratic tax cap that is worsening the achievement gap by making it impossible for poor school districts to ever catch up.”

NYSUT’s analysis, submitted as part of the union’s lawsuit seeking to have the tax cap declared unconstitutional, also compares student proficiency rates and per-pupil spending. In the highest-spending 10 percent of school districts, 49 percent of students reached proficiency targets on last April’s English language arts test, while 45 percent were labeled proficient in math. Among the poorest 10 percent, however, just 21 percent reached proficiency in English language arts and 18 percent in math.

Tags: budget, education, ncsymposium14, new york budget, new york state, NYS, nysut, schools, spending

.png)

What NYSUT wants is an increase in teacher salaries and an increase in teacher hires. Let’s not be confused by all the talk of helping students. How, exactly, will increased spending provide better education? NY already spends the most per student in the US.

Of course the union is advocating for more for its members. But it is still a valid point that spending twice as much on the wealthiest and easiest to teach is unfair.

I don’t object to a union advocating for its members, but they should be open and honest about it instead of always crying about the children. If NY needs to reform the way education is funded, so be it. This time, let’s try something other than raising taxes.

Larry asks “How, exactly, will increased spending provide better education?”

Well, apparently the wealthiest districts believe in spending more on their students. Maybe we should set up a funding scheme in which the wealthiest districts and poorest districts swap funding, then the next wealthiest and poorest swap, and so on. That way nobody needs to have a tax increase, and Larry will be happy.

And it is time we support the people who spend their days educating our children, keeping them safe, and in an increasing number of cases giving their lives to protect them.

I agree the inequity should be addressed, but getting rid of the tax cap is the wrong way to go about it. Poor districts have fewer high-taxed properties, fewer expensive homes and businesses; in New York they tend to be Rust Belt cities or rural areas that have been losing population for the past 50 years. If they keep raising taxes even more and more, more people are going to leave them, reducing the tax base even more and squeezing the people who are left until more of them leave. It’s just going to make the problems worse in the long run.

What we should do, I think, is turn to a statewide system for funding school districts. Maybe get rid of school property taxes all together, raise the income tax a bit to make up for it and distribute that money equitably. Or maybe keep school property taxes, but have most of it go into a statewide pot that gets doled out based on some need based formula like state school aid does now.

The NYSUT says (Quote) “What the tax cap does, in essence, is to take this grotesque educational inequality and accelerate it even more.” .

If the point is education funding reform, it seems strange to assail the tax cap.

The dirty little secret the union does not seem to understand is that high tax rates are emptying upstate New York of people, 3 million left between the 2000 + 2010 census.

If the union was interested in reform, they would support education funding from something other than property taxes. The median price for a home in the wealthiest NY districts can exceed $1million (Scarsdale NY $1,035,000 http://www.trulia.com/real_estate/Scarsdale-New_York/ ). To bring our school funding levels up to match districts like that is impossible through property tax levies and the comparison of the wealthiest districts and poorest districts is just theater.

I ask again: how, exactly will increased spending provide better education? If it did, we wouldn’t be having this conversation.

Maybe someone needs to define “better education”.

Larry, if your company cut your pay by 25%, would you work just as hard? Do private companies who want to improve the caliber of their workers offer higher salaries? Isn’t it a fundamental of capitalism that to get the best, you pay more? Education in New York State is expensive because New York is an expensive place to live.

Larry, increasing spending in wealthy districts probably will only result in marginal gains, but increasing spending in the poorest districts will almost certainly result in better performance. As Walker notes this is one of the core principles of capitalism, that is one of the prime reasons wealthy people send their children to private schools.

caveat to capitalism is you not only get what you pay for, but what you pay is not necessarily what it was worth.

another onions with many layers.

the largest school district in my county is rife with children of undocumented parents.

if you enroll your child in school it’s even harder for the sheriff to evacuate you from squatting in the dozens of vacant, foreclosure impending, homes.

add the breakfast, lunch and dinner programs, pre-k babysitting……..

“uncle” already

Now, to agree with Larry, to some extent, I believe the schools should be frugal with the taxpayer’s money. I am unconvinced that providing iPads to every kid in kindergarten will provide dramatically better results. Socrates, Plato, and Aristotle could provide a pretty good education with fairly meager resources. But I wouldn’t expect any of them to work for a song. In fact none of them would likely be certified to teach in our schools – never mind that Socrates was a known criminal.

Further, I think that education programs at college teach an unnecessary amount of teacher-speak mumbojumbo and that teachers should be well versed in their core subject area ( boy, I keep using that word “core”!)

All that said, it seems obvious on the face of it that poor districts will perform better with increased funding. And it would be the small stuff that might make the difference – having staff available to follow up on truant students, making sure kids are well fed and comfortable in classrooms, safe school environments…

Comparing state averages, NYS does spend a lot on education but that average is heavily skewed up by the very wealthy districts that have 35K to spend per student. NYS’s funding structure has already been found in court to be unconstitutionally inequitable. I believe that this inequitable funding is one of the biggest drivers in the growing gap between wealthy and poor in the state because our local students’ success continues to decline compared to state averages. This, contributes to a downward spiral of poorer employment prospects, higher welfare dependency, and greater economic decline in our rural communities.

Personally, I would MUCH rather spend money on 14 years of excellent education for every student than shovel cash into the ever growing welfare maw that will support half of them for the rest of their lives. The best possible solution is to do away with the current funding system and develop a new one that distributes state monies equally per student.

Schools are already the main employers/economic drivers and cultural centers in many of our small communities. If our rural schools were sound and sturdy with students receiving top-notch educations and had access to strong after-school and co-curricular enrichment programs, I believe that we would see a kind of community-wide economic growth that would ease distress among those who currently see schools and teachers as greedy money suckers. The North Country has a long way to go to overcome the deep layers of long-term poverty entrenched in our communities. If we don’t have sound, well funded schools and dedicated teachers, we will just keep sliding into the pit.

How the money is used is a bigger issue than just the percentage difference between high and low wealth districts. Money spent alone is not an indicator of superior results. Any reform-minded effort will need to reduce the number of districts and trim up the administrative overhead; reform the pension system; and will need to insist on measurable results. For a mind-warping mental exercise, explain why Keene spends $70,000 plus per student, and yet the Catholic schools spent $8,000 or so per student. Are the results eight or ten times better?

One way that more money spent in education results in better outcomes is that it offers teachers opportunities to show students what is possible.

For example: most of our schools have no money (and now no time with common core and testing requirements) for field trips. My husband has spent 16 years teaching the most at-risk students in the North Country. Early in his career, his programs had access to funds that would allow his students to go on field trips outside St. Lawrence County where they could see with their own eyes that there are people out there who are successful, have nice homes, work in interesting jobs and are NOT dependent on welfare or drug money to survive and even thrive. Classroom discussions and student attitudes were always different after those journeys.

A few years ago a friend was teaching a students from a 3 generation welfare-dependent family who thought that giraffes were imaginary creatures. She had never been to a zoo and had never had parents who read to her about the natural world. For a few weeks, her interest was really piqued by giraffes and other animals but sadly, she was already pregnant and deeply entrenched in the culture of poverty – her interest flagged and she eventually dropped out of school. She is an intelligent person, capable of far more than she will ever achieve. How might her life be different if she had had access to really enriching educational experiences from pre-K and on – things like an actual trip to a zoo to see a live giraffe?

The reason that we can’t imagine what good educational funding will do for our communities is that we have never seen it before. It is an imaginary creature as far as we are concerned.

OLarry: If you have evidence these numbers are wrong, let’s see it. Otherwise, it’s just a smokescreen to change the subject. People can disagree on how to respond to these facts, but no one yet has dispute their accuracy.

I see that when I agree with Larry I get more dislikes. I guess I’m going to have to stop agreeing with Larry; people don’t like it.

The real way to reform education is to centralize funding. You either have centralized standards with centralized funding or decentralized standards with decentralized funding. We know decentralized standards won’t happen anymore because politicians need the mandates to make themselves look good.

Centralized standards with decentralized funding inevitably leads to the sort of disparities.

In my opinion, education funding should work as follows. Anything that’s mandated by DC should be funded 100% by the feds. Anything that’s mandated by the state should be funded 100% by Albany.

Local school taxes would only fund those things which each district CHOSE to offer, such as sports, music and AP classes. Local funding for local choices. State and federal funding for distant impositions. This would necessarily lower school taxes considerably.

This would have the added benefit of being a deterrent. If legislators in Albany and DC were forced to pay for the mandates they fiat at 100%, they might be more careful about imposing them in the first place. It’s easy to impose standards that make you look good when you’re not the one who actually has to comply with them.

Brian,

I think the only smokescreen is the one you’re blowing at us. You know very well that I didn’t dispute the numbers. My point is that increased funding, which seems to be the only solution anyone ever thinks of, does not produce better education. If it did, NY would have the best education in the US, as we already lead in spending per student.

Larry, New York City has THE highest cost of living of any city in the nation, and since the metro area contains roughly half of the state’s population, it dominates the cost of education for the whole state. The cheapest cities to live in are in Idaho, Arkansas, Illinois, Colorado, Texas, Tennessee and Oklahoma. If you tried to pay teachers in New York City an average teacher’s salary from other states, you wouldn’t have any takers. So education in New York is just going to be expensive, period. You can’t say that we’re wasting money by paying teachers so much just because we spend the most on education.

Also, some of New York’s public schools are really good. Think there’s any chance that those are the ones with the cost per student of $35k? And if those wealthy school districts are driving up the average cost per student in the state, what skin is it off your nose, if you don’t live in one of those districts?

Would have to look more closely but I am not sure I understand why the “tax cap makes it worse”? I could see how it might make it hard to increase spending at a higher rate in a “poor districts” relative to the “rich” districts. But that would keep the problem where it is not make it worse. The “rich” districts are subject to the tax cap also (not that anyone is following it).

They have this in the press release:

“enacting an undemocratic tax cap that is worsening the achievement gap by making it impossible for poor school districts to ever catch up”

There is a big difference between this and the “tax cap making it worse”?

I don’t dispute any of the data but we should be careful with the conclusions and maybe the headlines.

I have to side with Larry, again. He isn’t blowing a smokescreen, he’s setting up a strawman. As we all know from the Wizard of Oz, smoke and strawmen don’t mix.

Paul, the tax cap makes the inequality worse simply because wealthy school districts have (presumably) plenty of room to cut costs without doing serious damage, while poor districts were already scraping bottom before the cap, and now have to cut to the bone.

I like Brian’s approach: “Anything that’s mandated by DC should be funded 100% by the feds. Anything that’s mandated by the state should be funded 100% by Albany.”

If you mandate it, you pay for it.

“My point is that increased funding, which seems to be the only solution anyone ever thinks of, does not produce better education.”

I guess you didn’t bother to read my solution, which did not call for increased funding, just a different structure. I’m guessing you didn’t read it by the fact that you didn’t engage it. Or either you read it and realized it would cause your straw man to go up in smoke. I’m not sure which.

Paul: Everyone is following the tax cap law. I’m not sure why you think otherwise.

Larry: you’re not one to question NYSUT’s motives since the only thing you reference is your own wallet… the same thing you condemn NYSUT for being solely focused on.

There is a map of district by district spending. http://www.cbcny.org/sites/default/files/InstructionalAndSupportMap.html

some of the highest costs are in the adirondacks on a per pupil basis.

The unprecedented decline in the quality of NY education has been concurrent with unprecedented increases in education spending. What makes anyone think more money is the answer? It hasn’t helped so far. NYSUT and its apologists ought to own up to their self-interest. It’s entirely possible that too much money is already being spent on education. Too many people in education are more interested in their own careers than they are in results.

“Paul: Everyone is following the tax cap law. I’m not sure why you think otherwise.” Yes, they are following the law in that they are doing the necessary voting to override the cap.

http://www.democratandchronicle.com/story/news/local/2013/11/17/tax-cap-overrides-may-increase-in-year-three/3621533/

“About 315 of the 1,200 taxing entities to report their plans to the state Comptroller’s Office indicated earlier this month they may override the property-tax cap, records show.”

Remember a correlation does not mean causation. I caution us all that this is all we are looking at here are correlations. The higher amounts of money spent per pupil may or may not be the cause of those students doing better (assuming that they are). The media (and special interest groups) love to throw around correlations both positive and negative. They rarely look closely at causation.

i asked my niece, a grade school math teacher, if she had a piece of chalk i could use.

she laughed and said we have been using white boards for years, actually she says white boards are getting phased out for “smart boards” ever hear of them? 20k or better.

she has the only “smart board” in the district. it enables her to draw a triangle, and the kids can stretch it, pull it, make a pyramid, blow it up almost getting inside an angle of the polygon.

i learned geometry as a flat one dimensional sketch.

i expect to see g*d d*mn geniuses coming out of our schools.

.. and i’m not seeing the correlation of that causation

Paul, news stories and studies don’t much cover causation because causation is incredibly hard to prove. But while it would be mighty hard to prove that spending more doesn’t lead to better outcomes, it would be just as hard to show that it doesn’t.

And voting to override the property-tax cap is following the law.

OLarry: any time you have an actual solution to propose, let’s hear it.

“The unprecedented decline in the quality of NY education has been concurrent with unprecedented increases in education spending.”

Sounds terrible!

Question is, is it true? I tried Googling “The unprecedented decline in the quality of New York education” and I came up blank. So I tried “education results in new york state by year” without much better success– true, there are stories showing that the new tests are showing poorer results than the old tests did, but that’s apples to oranges. Maybe you’ve got a source for your claims?

The problem with the cap on the levy is that it doesn’t put a cap on uncontrollable items in the budget.

It would be nice if the state imposed a cap on the cost of fuel and health insurance as a starter.

In terms of building projects, it would be nice if the state got rid of “prevailing wage requirements.”

All over the budget map for both schools and local governments, get rid of all of the mandates.

I could go on but these are just some of the problems I see.

My comments seem to have touched a nerve, especially amongst those whose vested interest must be in keeping the gravy train rolling. Everything I read and hear indicates that the quality of education has declined considerably. Nobody wants to talk about the real causes: parental indifference, societal problems, self-interested bureaucrats, pandering politicians, grasping, one-note unions, etc. No, it is so much easier to continue to throw money at the problem, especially when it’s somebody else’s money.

The tax cap is a problem because districts cannot increase their local tax base funding by more than 2% over the previous year based on a set of labyrinthine mumbo jumbo funding formulas.

Taken at a very rough sketch of the face value – districts that spend 35K per kid one year can spend an extra 700 bucks per kid the following year. Districts who spend 17K only get 350 extra.

So while all the costs of education continue to rise (heating the schools, gassing up the busses, paying the teachers, running the CSE meetings, meeting mountains of new and old unfunded mandates, paying for new curricula materials for new standards, etc….) poorer districts have a harder time keeping up with the demands and have to cut more and more enrichment & core programs and key personnel as their budgets sink further into the red.

“And voting to override the property-tax cap is following the law.”

Isn’t that what I said?

“But while it would be mighty hard to prove that spending more doesn’t lead to better outcomes, it would be just as hard to show that it doesn’t.” But we agree here that more money might solve the problem but it might not.

You could use stats to see where there is some causation. In fact you can find many cases where it is fairy simple to prove that spending more money doesn’t have a positive effect. Just like it is fairly simple to prove that it has a positive impact. My point was that from what is here you can’t really argue either.

There are lots of possible variable effecting student outcomes in both the rich and poor districts. Many of which have nothing to do with money.

One variable to also look at is where is the tax revenue coming from. In some of the “richer” districts it may very well in large part be from businesses that are paying large chunks of the property tax roll or even where they have PILOT’s from commercial entities funding large portions of a school district. What the “poorer” districts need for sustainable improvement in tax revenue for the school is economic activity. That cannot be achieved by driving away business with some of the highest tax rates in the country.

“Nobody wants to talk about the real causes: parental indifference, societal problems, self-interested bureaucrats, pandering politicians, grasping, one-note unions, etc.”

And you know that these are the real causes how exactly?

And how do you propose solving the problems of “parental indifference”? I thought you were a great believer in individual freedom?

How about those “societal problems”? What’s your proposed solution there?

Or do you figure that somehow spending less money will fix everything?

“What the “poorer” districts need for sustainable improvement in tax revenue for the school is economic activity. That cannot be achieved by driving away business with some of the highest tax rates in the country.”

So you think cutting tax rates in Newcomb is going to generate a whole bunch of economic activity there? How many businesses will relocate to a town where the schools are going down the tubes?

There are many, many problems in the world that cannot be solved by cutting taxes.

Burnett makes a good point about the evils of percentages. Equal increases seem to be fair on face value but are extremely unfair.

The same thing happens with wages. The more you are making, the more you get.

One worker getting paid $10,000 per year and gets a 2% increase receives an extra $200.

Another worker getting paid $100,000 per year gets a 2% increase receives an extra $2,000.

Year after year every thing gets compounded.

This is how the rich get richer and the poor get poorer and everything seems fair when it is far from it.

“Everything I read and hear indicates that the quality of education has declined considerably. Nobody wants to talk about the real causes: parental indifference, societal problems…” been hearing that one since as long as I can remember. Probably the cavemen had the same complaint.

If we could “cap the cost of fuel” that would be pretty cool!

OL: People ARE talking about the problems you cite, particular the folks in the education profession that know first hand the effects of these problems. Not too many people are listening, though. It’s easier to scapegoat the unions for all the problems, even when these teachers are highlighting many of the exact same problems you cite.

I agree with you. I’m not convinced that throwing more money at a dysfunctional structure is going to fix anything. But unlike you, I’ve actually proposed a solution. It may be easier to lean back in your chair and say no no no, but giving people something to say yes to is actually contributing something to the debate. That’s assuming debate is what you’re interested in.

“There are many, many problems in the world that cannot be solved by cutting taxes.”

I have not suggested cutting taxes here. Why do you want to drag the discussion down like that?

In fact if you look again at my comment I am suggesting that we should work to improve the tax revenues for the districts and do it in a sustainable way. Perhaps you and I just disagree on where the tax revenue should come from.

Paul: districts which vote to override the tax cap are following the law. An override based on a 60+% vote is provided for in the law.

As for whether they ought to override the cap, that’s another question. But it’s legal.

As long as the cap limits tax increases but not mandates, then overrides will only become more common. If you REQUIRE districts to spend more, more and more money, they are going to have to seek more, more and more revenue. It’s simple math. Change the structure to what I proposed and this gets under control.

Paul, you wrote: “What the “poorer” districts need for sustainable improvement in tax revenue for the school is economic activity. That cannot be achieved by driving away business with some of the highest tax rates in the country.”

Forgive me if I thought that meant you favored lowering those high rates. I’m not sure how else to read it. Please elucidate.

Oh, I get it. You want to keep taxing people, but lower rates on business, is that it? I still don’t think that’s going to get Newcomb anywhere, do you?

Going back to Philip Williams 8:41am claim that Keene spends $70,000 plus per student, Peter Hahn’s 1:10pm link shows Keene spending $25,643 per student.