Teachers Union: Rich districts spend 80% more than poor ones to teach students, tax cap makes it worse

NYSUT graph showing per-pupil spending ranges in New York State. Image: NYSUT press release

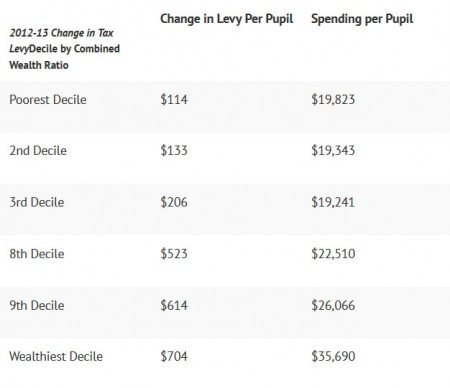

The New York State United Teachers (NYSUT) has today released an analysis (press release, h/t Politics on the Hudson) showing that the wealthiest 10 percent of our state’s school districts spend 80 percent more on teaching students than do the poorest 10 percent, “a funding inequity that is aggravated by the state’s property tax cap and widens the unacceptable achievement gap.”

The NYSUT analysis found that the top 10 percent spent an average of $35,690, compared to $19,823 for the poorest 10 percent last year, although students in poorer communities tend to have much greater educational needs (Much more detail in the press release.)

NYSUT is challenging the tax cap in New York state Supreme Court; that case is set to be heard on Dec. 12. Here’s more on what NYSUT had to say about the tax cap and its impact on students:

“The way New York funds public education is already grossly inequitable, denying the poorest students with the greatest needs the rich array of programs and services they need for success – services more affluent students get every single day,” said NYSUT President Richard C. Iannuzzi. “What the tax cap does, in essence, is to take this grotesque educational inequality and accelerate it even more.”

Iannuzzi said funding inequality and the effects of poverty have a devastating impact on student achievement and graduation rates. He noted that roughly half of New York’s 2.7 million schoolchildren are so poor they qualify for a free- or reduced-priced lunch. New York City has an estimated 50,000 homeless students, and many more homeless youngsters populate shelters and abandoned structures in small cities, the suburbs and rural communities across the state as well.

“Students who are furthest from reaching the state’s higher standards and who are at the greatest risk of dropping out are very often from communities of color or families that live in poverty,” Iannuzzi said. “Instead of investing more to help students in high-needs communities succeed, New York has done the opposite, creating a tax structure that widens the wealth gap and enacting an undemocratic tax cap that is worsening the achievement gap by making it impossible for poor school districts to ever catch up.”

NYSUT’s analysis, submitted as part of the union’s lawsuit seeking to have the tax cap declared unconstitutional, also compares student proficiency rates and per-pupil spending. In the highest-spending 10 percent of school districts, 49 percent of students reached proficiency targets on last April’s English language arts test, while 45 percent were labeled proficient in math. Among the poorest 10 percent, however, just 21 percent reached proficiency in English language arts and 18 percent in math.

Tags: budget, education, ncsymposium14, new york budget, new york state, NYS, nysut, schools, spending

.jpg)

Something interesting here that may help explain those Adirondack costs in Peter Hahn’s 1:10 map. I think I’m agreeing with Larry that at least partially it depends on what the schools spend their money on. According to this study, http://www.shsu.edu/~pin_www/T@S/2011/schoolfinance.html, schools that spend less than 60% of per-pupil budgets on instruction have worse educational results. (On the other hand, increasing that ratio to 65% without spending more on things like libraries and counselors does not improve performance. Go figure.) I’m betting those central ADK districts spend an awful lot of their per-pupil budgets on energy for buses and unfrozen classrooms.

Interesting article, OA, but the idea that there could exist a magic percent-of-budget-spent-on-instruction seems pretty suspect to me. As you point out, there are those energy and transportation costs that affect different schools differently. Then there’s the economy of scale effect, giving larger schools significant advantages.* Then there’s the average years of service of the faculty– older faculties will cost more than younger ones.

There’s also a question about what money the 60% rule applies to. The article starts off saying “of the money sent to school districts [presumably by the state], 65 percent of it should be spent on instruction.” But later in the article, it seems to be talking about the entire budget. Or does Texas supply the entire budget? What does this sentence mean: “Because of the complicated nature of Texas’s funding formulas, or where the state appropriates money, it is difficult for anyone to understand the issues that surround them, which isn’t good for anybody, Jones said.”

In any case, it seems pretty clear to me that a school that spends $35,000 per student can afford to spend a much smaller portion of its budget on instruction than one that spends $19,000 per student.

*I realize that the article addresses some of these issues, but it does so pretty confusingly: what does this mean: “Bigger isn’t necessarily cheaper; small schools are the most expensive to operate”?

https://www.youtube.com/watch?v=XchNCnYo6KA

A clarification about overriding the tax cap. Municipal governments can override the cap if 60% of their board agrees – so 3 members of a 6 member board must vote yes to override the cap. School districts must get 60% of voters to vote yes in order to override. Only 4% (28 districts) even attempted this. 75% of those budgets failed.

http://www.nyssba.org/news/2013/05/22/press-releases/overall-95-of-school-budgets-pass/

“Oh, I get it. You want to keep taxing people, but lower rates on business, is that it?”

No, I don’t think you do. Where did I say tax businesses at lower rates? Also, even if you support a tax cap (not that I do personally) you still support raising tax rates by some reasonable amount on all property owners.

Newcomb’s problem is not that they are not sufficiently taxing the property owners. Their problem is that they do not have sufficient economic activity to support themselves.

Paul, you wrote: “What the “poorer” districts need for sustainable improvement in tax revenue for the school is economic activity. That cannot be achieved by driving away business with some of the highest tax rates in the country.”

If you think that “some of the highest tax rates in the country” is preventing the economic activity that the poorer districts need, you’ve got to lower someone’s taxes. But instead of telling me what you didn’t mean, why not tell me what you would propose they do?

It is a tough question for a place like Newcomb if we want to stick with that example. They are surrounded by state land and or easement land where development is restricted or prohibited by law. If commercial activity is basically banned I think economic expansion (of any kind) is basically prevented so I am afraid for a place like that I am not sure what they can do. Tourism is their main economic pillar. The state does pay property tax on the land we own but that land is not going to appreciate in value and assessment like private land (one of the important factors that probably helps the “richer” school districts we have) could so they are really in a tough position.

Walker, do you think that simply raising property tax to meet the funding needs of the school district is a sustainable thing when it is basically on the back of residential property owners who are not really in a position to afford the increases over and over? The tax cap aims to do that so in an area like that I would probably personally support a tax cap of some size. Not a freeze on taxes but a reasonable limit to the growth in tax rates over time.

Sorry, like you I don’t have all the answers. I wish I did.

Also, some of the income taxes that NYS depends on (for paying things like the tax on state land I described above) will probably be leaving NYC as the new mayor implements his new tax policies. So things for places like Newcomb could get a lot worse.

Actually I should probably rescind that comment. I don’t actually expect that there will be much of that, at least I hope not.

The only thing I don’t really understand, well not the only thing, but local taxes in the North Country don’t come close to funding local education. Our property taxes I think are paying about 20% of the school budget, the rest is coming from the state. So the property tax cap here, is relatively meaningless and is certainly not the cause of our budget woes one way or the other.

So given that, how can these disparities exist? Are wealthier districts being given substantially more from the state or do wealthier districts simply pick up more of the total burden and thus have a larger budget? I think the state formula’s should certainly favor the districts more in need.

How do we stack up in the North country on total amount spent per student?

The other issue is amount spent on teaching. Research does show excellence in teaching does matter, more than curriculum more than common core more than any of these education schemes we come up with every four or five years as the latest wave of new ways to sell new textbooks; it comes down to teaching.

So paying teachers more in less well off districts would be very important in my mind. However paying teachers more is not paying janitors, coaches, school counselors, principles, assistant principles, new buildings etc, more. It is about getting money in actual class room teaching.

Teachers unions need to be about teachers.

“Walker, do you think that simply raising property tax to meet the funding needs of the school district is a sustainable thing when it is basically on the back of residential property owners who are not really in a position to afford the increases over and over?”

No, I think Brian had it right– let those who impose mandates on schools pay the costs of those mandates.

Not that there’s much hope of moving to that model any time soon. Notice though that the tax cap reduces the incentive of property owners to demand increased state and federal funding, while probably doing some serious damage to smaller, poorer school districts. So the tax cap is, in my opinion, exactly the wrong solution.

And in anticipation of howls from OL about the idea of spreading the costs to NY and federal taxpayers, I think there’s plenty of room to increase top marginal rates for both state and federal taxpayers. And how about the financial transaction tax? Willie Sutton had it right!

“Our property taxes I think are paying about 20% of the school budget, the rest is coming from the state.”

Is that true, Mervel? Do you have a source? I just spent 20 minutes looking and couldn’t find any info that addressed the issue.

Mervel, the only info I can find shows that $19,372 of Saranac Lake’s $28,080 cost per student is borne by property tax payers. (http://www.empirecenter.org/Documents/PDF/Spotlight2013-14.pdf )

a lot of school taxes on property in the north country is being paid by property owners who do not have , or never had , any children in the district.

a lot of school taxes are being lost due to illegal multiple family uses on a single family, residential zoned property containing assessory apartments.

should school taxes, and their burden, be accurately reflected, and paid for by federal income tax on people with school aged children?

too simplistic?

“should school taxes, and their burden, be accurately reflected, and paid for by federal income tax on people with school aged children?”

Not so much too simplistic as missing the fact that educating children is good for everyone, even us childless folk. Also, it would be politically unpalatable to enact what would effectively be a Tax On Children. But I’d be all for using more federal tax money for schools.

that fact was not missed. I am aware that funding education is my “protection” money paid to a “mob” in exhange for the premise of being able to walk down my street, unmolested by the educationally “challenged”.

that’s extortion, not government.

and yes, children should be taxed.

what is politically unpalleteable is the notion that something won’t get done because it is politically unpalletable.

I have my own lists….

How long do we have to continue to listen to the “educating children is good for everyone” cliche without an acknowledgement that American public education is based on and funded by a societal model that no longer exists? The essential ways and means of education haven’t changed since the early to mid 19th century, when most people had multiple children, one home and one set of taxes to pay. Now, in some cases the majority of taxpayers don’t have children, have multiple homes and pay taxes to multiple entities. These are life choices people have made and they generally don’t ask anyone else to support or pay for them. It boggles my mind that some people expect others to support and pay for the choices they have made, pay redundant taxes and pay taxes to government entities from which they are not entitled to representation or a vote. And you wonder why some of us say, “don’t raise taxes”?

Two cents, the reason we should all pay for educating the nation’s children goes way beyond safety on the street– the economy depends on an educated populace, as does our political process.

And when you find a country where good laws are passed despite being politically unpalatable, let me know.

Larry, surely you have no problem thinking of the problems of employers: what if none of their job applicants can read and write, or add and subtract? The economy needs an educated workforce.

” These are life choices people have made and they generally don’t ask anyone else to support or pay for them.”

And if only those who choose to have children are asked to pay for their education, how high do you think school taxes will go? And I assume you would argue, too, that parents with children in private schools shouldn’t have to pay public school taxes, right? So if, as would almost certainly be the case, those with school-age children can’t afford to pay school taxes, what then?

It was good enough for the Founding Fathers, Larry: “Government-supported and free public schools for all first began to be established after the American Revolution and proliferated in the 19th century…” (https://en.wikipedia.org/wiki/Public_education_in_the_United_States#History)

I understand the complexities.

what i’m not buying is if the economy NEEDS a mcdonalds on every street corner, or the people that are DOOOOOMED to work there.

I want smart children proliferating the earth.

tell me how that’s working out?

ps

if you show that your child is enrolled in a private school you pay for, then you’re exempt from the federal obligation. that’s radical thought for some, for sure.

pss- the founding fathers are dead. leave ’em be. there not here to tell us what they meant or what it means now.

systems are prone to failure. time to put away the duct tape, and swap out the faulty part for one that performs.

take that to any exterem you want. i’m being glib, and angry, and overburdened, and……..

*extreme (fat thumbs today)

walker

we live in a country that passes laws (“good” is the very crux of the dispute and open to perspective) that are politically unpalatable.

its palatability should be regardless. like medicine.

laws are passed everyday that I would find unpalatable, they are no doubt palatable to others, while other just take what is put in front of them, like it or not

.. and really the question was are we paying for education, or paying teachers.

Well, 2c, I ask again, how do you think poor and lower middle class parents are going to come up with the money to pay the full costs of their children’s education?

As for wanting smart children proliferating the earth, what’s your proposal for bringing that about? Eugenics has an ugly history!

The conversation is getting pretty weird!

“Notice though that the tax cap reduces the incentive of property owners to demand increased state and federal funding, while probably doing some serious damage to smaller, poorer school districts. So the tax cap is, in my opinion, exactly the wrong solution. ”

Walker, I am not quite sure I follow you here? Can you explain this more? Has there been a decrease in property owners demands for state and federal funding over the past few years that the tax cap has been in existence? Maybe? I have no idea. We should probably look at other states where these type of tax caps have existed for longer to get a better picture of any effects.

No, Paul, this is a purely speculative opinion. But it seems pretty obvious that property owners who pay steep school taxes have an incentive to push for state and federal governments to pick up a greater share of school funding, and that anything you do to limit school property taxes will reduce that incentive.

Feel free to explain why you would disagree with the reasoning.

In NYS we pay the highest local taxes in the country as a percentage of personal income. How much more do we think we should be paying if taxes is the solution to this problem? We are 80% above the national average. What do we think is fair? 100% higher 200%?

The other advantage to pushing education costs onto state and federal income taxes is that it helps equalize school funding across wealthier and poorer districts. Of course, you won’t think that’s a good thing if you believe that kids who grow up with the huge advantage of wealthy, well-educated parents ought to also have the best-funded schools.

I don’t disagree with the reasoning. I was just curious if there was any evidence that this is the case. The reasoning that it also could be an incentive for districts to look for other solutions is sound as well. There also may be no evidence that it works that way either, I don’t know. Increasing property tax, like many things, negatively impacts lower income individuals the most. The folks who’s rent goes up because their landlord has a 15% higher property tax bill are really hurt by it. So this isn’t a rich poor issue. I personally think that school taxes based on income probably makes more sense.

“The other advantage to pushing education costs onto state and federal income taxes is that it helps equalize school funding across wealthier and poorer districts.”

Isn’t that something that a property tax cap would do?

Not all by inselft. Did Andrew combine the tax cap legislation with a significant increase in state-provided school funding?

(Honest question– I have no idea. If he did, though, why are school districts scrambling to either cut drastically or to pass budgets with 60% majorities that exceed the cap?)

I don’t know much about this, although I probably should with two children in NYS funded schools, but what is the major need for a “significant” increase in school funding in an economy with almost no inflation?

BTW a 2% increase is already a significant rise from year to year. Remember that also includes all the taxes that were paid last year before the increase.

And the big question why do so many other states do so well with so much less?

The state budgeted 610 million more dollars in 2014 than they did in 2013. A 3.04% increase from year to year. So 3% from the state and at least 2% more locally. This doesn’t include increased tax revenue from property assessment increases.

For this discussion do we know how much more we would need to do to end the “scramble”?

I think I heard somewhere that when you look at State provided funding from 2008 to 2012-13 you will see that the State actually provided less money in 2012-13 than they did in 2007-08. At least that’s what my neighbor tells me in this district.

Hugh Hill said at 8:54 pm 12/2

“The dirty little secret the union does not seem to understand is that high tax rates are emptying upstate New York of people, 3 million left between the 2000 + 2010 census.”

According to the US Census, in 2000 NYS’s population was 18,976,457. In the 2010 census it was 19,421,055–up nearly half a million.

New York City’s population increased about 160,000 over that period, leaving an upstate (or at least a non-NYC) population increase of more than 300,000.

Dale Hobson, NCPR

Walker that was from the Canton Budget, and on your link (thanks), they come in at 34% local tax levy as the total while Saranac Lake does come in at 68% local.

So really those are very large differences. It seems to me that the state would start by looking at how to make these distributions more equitable.

Of course the real solution is to stop funding our schools by using a local property tax.

The point of public schools the point of the whole system is to provide a public good that will help everyone by providing what is essentially one of the few social evening devices we have in this country. Its unique to the US in its origins and is American in its ideal that we all can have an even shot at some level. If we just replicate the essential unfairness in our culture within the public school system there is no point to having a public school system.

“Well, 2c, I ask again, how do you think poor and lower middle class parents are going to come up with the money to pay the full costs of their children’s education?”

yeah sounds like a hard teet there. maybe some people cant afford to be parents.

there are a lot of things I cant afford. basics too. I take it on the chin, I don’t expect to get anything from the government. I don’t fit the popular demographics, the ones that get help anyway. I should not have to do without heating oil, gas for my work commute, healthy food choices, because someone’s kid needs to be educated. especially someone who has come to this country to get the benefits of our government. not at the cost of me doing with less and less. when is it ok for me to squeal?

is it my responsibility to carry that load, you know so the smart kids that result from those efforts can make a better world for us?

like I asked before- hows that working?

this country is shot

I understand your points, and how the grand scheme is supposed to work out.

my point of contention is it isn’t!

We have it too good here in the US. Ask a Syrian refugee, or a Haitian, or Bangladeshi if it would be worth it to get the security, safety, education that we have here along with the tax rate and opportunity to work hard just to see your kids had a chance to get ahead and I doubt you’d find many refusals.

I’m really sick of hearing people complain about their taxes, especially the people with $million lakefront vacation homes. I hear that Afghanistan has very low taxes, try moving there.

this isn’t Syria or people would be in the street, armed and angry instead of venting on a blog.

im not a lakefront millionaire.

maybe you have it too good here, speak for your self.

where do you go when you’re a refugee in your own country?

where do you go when refugees from elsewhere are given priority over one’s own refugee-ness.

im not complaining about taxes. I’m saying I often don’t agree with the allocation.

having smart children in the future, supporting another poorer persons child should not take precedence over my own self determination, or survival.

maybe you should visit Afghanistan.

I’ve travelled to some third world countries, to build. I’ve given to the grater causes, volunteering to build for others what they cant do for themselves.

the trouble is, returning to my homestead, i’m met with my own poverty.

I can build a school in belieze, (so belieze can educate its OWN people) easier than I can get a permit for a outdoor wood furnace so I can have the opportunity to harvest, chop, split my own firewood for my own heat.

I resent the implication that if you fail in this country, its because of something you must have done, or not done, to your self.

Of course things are good here. Are we to be blamed for wanting to keep them that way? I’ll continue to complain about taxes as long as I continue to pay them.

Two Cents, I wasn’t speaking of anyone in particular. Nor was I making any implications about people “failing”. And I agree that the allocation of tax receipts should be carefully managed in a fashion that provides the most value for society in general. I believe I made that point previously here.

I am tired of people who constantly complain about taxes but don’t want to listen to people who have a different point of view on how to resolve problems. I’m sick and tired of the people who benefit the most from the opportunities our country has made for them – largely through the allocation of tax money paid by everyone, including the poorest among us – incessantly bitching even as the tax structure benefits them the most. And I’m sick people who are not at the top of the income spectrum being easily manipulated into doing the bidding of the obscenely wealthy.

KHL,

It’s hard not complain about taxes when the “different point of view on how to resolve problems” always includes raising them. I’m also sick and tired of the often repeated fiction that anyone with anything got it by oppressing the “poor”. Most of them are too busy taking care of themselves to waste any time thinking about the poor, except maybe when they are contributing to charities (who do you think does that, poor people?) or paying the lion’s share of the taxes already collected in this country. I’m also sick of those who constantly try to guilt people out of enjoying their success by implying that it wasn’t fairly achieved.

Knuck, I hear what you say but here in this state (just speaking relative to the US now) the obscenely wealthy property owners (including the lake front cats you were talking about) are paying just about the highest tax rates as anywhere. That isn’t a complaint really, it is a fact. What people can and should be complaining about is that despite these insanely high property tax rates we are not doing a good job educating all of our children.

But children should take priority. They are the future and they are the poorest demographic in the United States.

So if it comes down to spending money on the elderly or the young, we have been veering all of our resources toward the elderly not the young.

Many more tax dollars are spent on taking care of and paying for the needs of the elderly than are spent on children, particularly poor children. Which to me is not a smart plan for spending.

Now if you want to go libertarian and make that argument two cents, then yes we should not be spending money on either, that is an argument to make. But if we are going to have public investment than I think a very strong case can be made that it is allocated toward public education as a priority.

Now I think we could do much better and be more efficient and more accountable. But the basic concept of wanting to use my tax dollars to educate a child, regardless of their coming from a rich or poor family, is a very good use of my tax dollars in my opinion.

Property taxes are the wrong way to go though.