Teachers Union: Rich districts spend 80% more than poor ones to teach students, tax cap makes it worse

NYSUT graph showing per-pupil spending ranges in New York State. Image: NYSUT press release

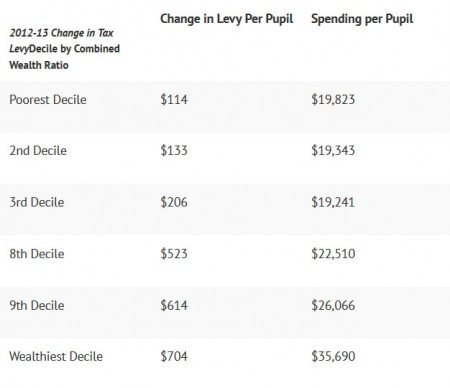

The New York State United Teachers (NYSUT) has today released an analysis (press release, h/t Politics on the Hudson) showing that the wealthiest 10 percent of our state’s school districts spend 80 percent more on teaching students than do the poorest 10 percent, “a funding inequity that is aggravated by the state’s property tax cap and widens the unacceptable achievement gap.”

The NYSUT analysis found that the top 10 percent spent an average of $35,690, compared to $19,823 for the poorest 10 percent last year, although students in poorer communities tend to have much greater educational needs (Much more detail in the press release.)

NYSUT is challenging the tax cap in New York state Supreme Court; that case is set to be heard on Dec. 12. Here’s more on what NYSUT had to say about the tax cap and its impact on students:

“The way New York funds public education is already grossly inequitable, denying the poorest students with the greatest needs the rich array of programs and services they need for success – services more affluent students get every single day,” said NYSUT President Richard C. Iannuzzi. “What the tax cap does, in essence, is to take this grotesque educational inequality and accelerate it even more.”

Iannuzzi said funding inequality and the effects of poverty have a devastating impact on student achievement and graduation rates. He noted that roughly half of New York’s 2.7 million schoolchildren are so poor they qualify for a free- or reduced-priced lunch. New York City has an estimated 50,000 homeless students, and many more homeless youngsters populate shelters and abandoned structures in small cities, the suburbs and rural communities across the state as well.

“Students who are furthest from reaching the state’s higher standards and who are at the greatest risk of dropping out are very often from communities of color or families that live in poverty,” Iannuzzi said. “Instead of investing more to help students in high-needs communities succeed, New York has done the opposite, creating a tax structure that widens the wealth gap and enacting an undemocratic tax cap that is worsening the achievement gap by making it impossible for poor school districts to ever catch up.”

NYSUT’s analysis, submitted as part of the union’s lawsuit seeking to have the tax cap declared unconstitutional, also compares student proficiency rates and per-pupil spending. In the highest-spending 10 percent of school districts, 49 percent of students reached proficiency targets on last April’s English language arts test, while 45 percent were labeled proficient in math. Among the poorest 10 percent, however, just 21 percent reached proficiency in English language arts and 18 percent in math.

Tags: budget, education, ncsymposium14, new york budget, new york state, NYS, nysut, schools, spending

.jpg)

.png)

Real Man Two Cents sez: “I don’t expect to get anything from the government. I don’t fit the popular demographics, the ones that get help anyway. I should not have to do without heating oil, gas for my work commute, because someone’s kid needs to be educated. especially someone who has come to this country to get the benefits of our government.”

Except for the government subsidy of heating oil and gasoline, and the government subsidized roads, and the government-created Internet he can rant on, he doesn’t need anyone’s help.

Larry, your contention that people who have differing opinions on how to solve problems always want to raise taxes is totally false. Do you think that you are the only person who pays taxes? Liberals pay taxes too and nobody likes to see money wasted. I pay taxes and I don’t like it when the county doesn’t do necessary road maintenance in order to save money in the short term because in the long term they will have to spend more later. Perhaps you think that is an example of wanting to increase taxes but I think it is an example of keeping spending down.

You say: “I’m also sick and tired of the often repeated fiction that anyone with anything got it by oppressing the “poor”. ”

That is simply not true. Everyone recognizes that some people have achieved in extraordinary ways, whether it is in business, finance, the arts, science, math… But you must also recognize that NOBODY achieves anything on their own. They have support from their friends, family, workers and co-workers, and the society at large which provides police, fire, military, transportation, etc. are you willing to acknowledge that the taxes people pay benefit business and commerce?

As far as charity goes, I certainly appreciate anyone who supports worthy causes! whatever they may be, but don’t try to hold the wealthy up as being exceptional in that regard. Studies have shown that the poor tend to be more generous in giving to charity as a percentage of their income than the wealthy. On average, of course.

Finally, I have no problem with people enjoying their success. I just don’t like to listen to people who have been successful complain about paying taxes. I especially don’t like to hear it from people who can afford to pay sales tax but want to pay me in cash so that they don’t have to pay sales tax. That isn’t an example of being clever, it is an example of being a cheat.

knuck,

are you implying im being manipulated? that my thoughts and feelings, are not mine? go take a hike

And how about you making a concession for once. Why don’t you make a public admission that people who are poor may, in fact, be BETTER money managers that many wealthy people?

Being poor doesn’t mean you are stupid. Poor people know that if they had capital they wouldn’t have to buy things on installment plans that cost them too much money. Poor people know that they should probably see a doctor if they feel sick or take their sick child to a doctor, but poor people don’t have the savings set aside to allow the luxury of going to the doctor unexpectedly. Their finances have been allocated for food, transportation, and housing and going to the doctor means that they might miss a payment. Missing a payment might mean that they end up paying usurious interest rates on a bill. They might end up paying 30% interest or more on a bill because their child got sick.

Even poor people aren’t so stupid that they don’t know 30% interest is criminal, but somehow the CEO’s of major banks think it is just fine and they have had the laws re-written to make usury legal.

Go ahead, defend usury.

I don’t think poor people are stupid. I know that disappoints you, but I don’t. At the same time, I also don’t think there’s anything noble about being poor. Defend it all you want, it smells a lot like sour grapes to me. If you don’t like cheating on sales tax, don’t do business with people who do.

By the way, the “30% interest” you refer to is part of the standard credit card terms that anyone who has one should know about. Maybe there are stupid people out there…..

oa-

I use the internet wifi at a library. I share a ownership of a laptop.

are you insinuating that I should be happy with the little I have and move on? (that is after I kiss my government’s arse for the wonderful things it “GIVES’ me?

please, you’re showing your ignorance.

and what’s the real man comment? feel threatened by a strong opinion?

those subsidies you mention are crumbs the government provides to placate the citizenry.

I consider it payment in exchange for not taking to the streets in full sedition regalia like those in Syria, Libya, ……

Larry, being noble isn’t a function of wealth. And there was a time, not long ago, in which 30% interest rates were illegal in this country. What have we become?

To a large extent we have become a country of people who expect others to take responsibility for the things we do without thinking. or at least without careful planning. 30% interest is outrageous, but it is also voluntary. People max out their credit cards, use home equity lines to buy cars & boats, etc., fail to make mortgage payments and then blame the credit providers. That’s what we’ve become.

Now two cents has a point about government allocation in several respects. The fact is we don’t do much of anything for individuals without children who happen to be working really hard yet don’t make a large income. If you are a person who has been working, struggling, conserving and so forth and still would like a little help from a government program to get ahead a little; as many people do, the best thing to do is go have a kid or two, turn 65 or come up with some sort of a disability, otherwise you are pretty well out of luck as far as help from the government. So yeah I can see if you are making minimum wage and don’t have any children and are under 65, you would have some resentment when you look around at people who are not doing anything but are getting assistance essentially because they have kids, I get that.

Plus all of the spending on our school systems.