Why did NY Republicans sell out the state’s millionaires? They’re not from around here.

Last week’s landmark income tax reform deal locked in higher tax rates for high-wage New Yorkers and the deal was embraced by many Republican leaders who are generally low-tax advocates.

Last week’s landmark income tax reform deal locked in higher tax rates for high-wage New Yorkers and the deal was embraced by many Republican leaders who are generally low-tax advocates.

Nassau County state Senator Dean Skelos — who leads the GOP majority — shrugged off concerns about locking in higher tax rates for the wealthy, pointing out that the deal included a tax cut for the middle class.

That view was echoed by state Senator Betty Little from Queensbury, the Republican who represents much of the North Country.

The decision by Republicans to side with Democratic Governor Andrew Cuomo on a tax increase has drawn fire from some conservatives, but here’s one political reason the move might make sense politically:

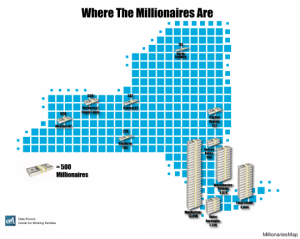

Republican districts just don’t boast that many millionaires.

According to a probe of tax returns (which you can see in full here) conducted by a labor group at the City University of New York,83% of the state’s citizens who earn a million dollars a year or more live in Manhattan, on Long Island, or in Westchester and Putnam Counties.

Nearly half of the state’s million-dollar-a-year club lives in Manhattan alone.

Those regions have emerged as largely Democratic strongholds, though Putnam County is now represented by a Republican lawmakers.

By comparison, only .05% of the state’s wealthiest earners live here in the North Country, 111 of them in total according to 2008 returns. Fewer than 2% of North Country residents even earn $200,000 a year.

So while the GOP may have an ideological lean away from higher taxes, the fact is that few of their constituents will be affected adversely by this tax deal.

This dynamic may also be reflected in the Republican push to shift far more state government costs — particularly for costly Medicaid programs — onto income tax payers and away from property tax payers.

If successful, that effort would almost certainly mean even higher income taxes, and it would likely mean even more North Country programs being paid for by taxpayers downstate.

“Those regions have emerged as largely Democratic strongholds”

Hmmm. Millionaire districts favoring Dems.

Kind of contradictory to the populist narrative connected with the Obama policies, and, in general, the Democratic policies.

Must be something in those policies that the rich-rich really like.

The rich-rich really like crony capitalism. They also like crony socialism. Probably, they don’t mind crony dictatorships, for that matter.

To be fair, most of the rich do know which side of their bread is buttered.They know they need the middle class and the poor because they know the middle class and the poor need money to buy what the rich have to sell.

Then let’s look at the reality of the rich. Some were middle class or poor before they became rich and they know how tough it is.

Others were born into wealth and know “that there but for the grace of god” they might have been born poor and struggling to survive.

Some are selfish and stingy but not all.

The wealthy have made some of the most important contributions to this country. I think they are getting a bad rap these days:

Stanford, Carnegie, Rockefeller, Noble, Whitney, Buffet, Gates….

We actually owe the evil 1% for much of the progress that we have today. To some on the left they are just a punchline that can hopefully get them elected or re-elected.

Paul, you have to read your history with rose-colored glasses to see all of the gentlemen you name as unadulterated heroes. And it would be easy to produce a considerably longer list of wealthy villains (say Jack Abramoff, Ivan Boesky, Andrew Fastow, Charles Keating, Ken Lay, Bernie Madoff, Tom DeLay, for starters). And that little list ignores the reality that much corporate malfeasance never gets hung on an individual’s door, or the fact that great wealth has insulated many a malefactor from punishment.

A good place to start looking at the other side of the coin is http://en.wikipedia.org/wiki/List_of_corporate_scandals

Remember your friend Andrew Carnegie’s dictum: “A man who dies rich dies disgraced.”

Bill Gates is a good example for this discussion.

This was a kid who built computers and wrote software in a garage. He was not the “evil 1%” when this was going on. He was the 99%.

His important contribution to this country is what made him rich – not the other way around. And he has been handsomely rewarded for this contribution, beyond imagination.

Now, he is one of the many 1%’ers who realize that he benefited not just from his great ideas, but also from the society that gave him the opportunity to realize them. He understands and accepts that he has a bigger obligation to that society, because he benefited from it so greatly.

Here is a direct quote from Bill:

“In terms of the very rich … Warren Buffett and I are the two wealthiest Americans — are certainly believing that the rich should be taxed a lot more…and the rich should give away more wealth than they currently do. And we’ve certainly been willing to speak out about that.”

Stanford, Carnegie, Rockefeller, Noble, Whitney, Buffet, Gates…

Most of them did not start out wealthy. And some became wealthy by questionable means. Regardless, there is no data that shows the “wealthy” are the prime job creators. Most jobs are created by small businesses which are rarely started by millionaires. Yes, alot of these people become wealthy but most were not wealthy when their business was growing and hiring the bulk of their employees.

Any government tax policy regarding job creation should require proof that real jobs were actually created before tax credits are granted.

Walker, it is a monumental stretch to read my comments and say that I see them as “unadulterated heroes”. My point is a simple one. Look around this country at the institutions that these folks have made, and the good that they have done. To use your term it is heroic.

Almost every public and private institution in the country owes its financial bedrock to the “evil” goings on on wall street. I know this is a hard concept for some to grasp but it is a fact.

It is interesting that when you throw up some names like I did here you quickly get comments about how these folks should be taxed more. Good job you guys are right on message!

When discussing taxation and the wealthy it should be noted that the contribution of tax revenue paid by the higher wage brackets has almost doubled in 30 years.

Now some will argue that this is because of the “income gap”. These individuals have become more wealthy so they have contributed far more money in income taxes over that period.

This huge increase in government revenue from wealthy individuals occurred in a period of falling tax rates for these individuals. Would that have occurred with rising tax rates for these individuals? This is an important question.

Well the fact is we need to tax people to run our government. Some conservatives just cover their ears and eyes and say that we should just cut government but then can’t name real programs to cut and even if they could it still wouldn’t be enough, we borrow .40 cents of every dollar we spend in the US, you can’t make that up by lowering spending. It makes some sense to have a progressive income tax system. I would be in favor of a wealth tax on financial assets above a certain threshold. The best tax from an economic standpoint in my opinion would be a very very large and comprehensive inheritance tax. It meets many needs, it does not distort work decisions, it is done after you are dead so you don’t even notice it, it does not take any money from anyone who earned that money.

“The best tax from an economic standpoint in my opinion would be a very very large and comprehensive inheritance tax.”

That would certainly eliminate many of the important privately funded institutions that we have as well.

Paul, think about it. Because a much, much higher proportion of the nation’s money is now going to the top tenth of one percent, they have had to pay a lot more in taxes, even though the top rates were lowered under Reagan and Bush.

You don’t have to look very hard to find good discussions of the pernicious banking practices that have played a major role in siphoning off the wealth of the lower and middle classes into the pockets of the wealthy. You have read about the slice and dice mortgage packages that investment banks DESIGNED to fail so that they could sell short and make a killing? That’s the tip of a very large iceberg.

It often takes many generations to build up the type of wealth that it requires now to build large institutions that can do this kind of philanthropic work. Taking that money out of the markets and giving it to the government to throw down one of its many rat holes hurts all segments of the economy. Mervel, the government can’t tax its way out of this pickle.

Here is an interesting story on what might with Steve Jobs’s money now that he has died.

http://www.forbes.com/sites/davidwhelan/2011/10/28/where-will-steve-jobs-money-go-medical-philanthropy-has-different-flavors/

For Mervel the answer is simple. Give it to the government.

Sorry I left out a “happen” in the first sentence.

We taxed our way out of the Great Depression and World War II. Don’t know why it wouldn’t work now, at least if we can keep the hyper-wealthy from twisting every program designed to help to their own benefit.

“Paul, think about it. Because a much, much higher proportion of the nation’s money is now going to the top tenth of one percent, they have had to pay a lot more in taxes, even though the top rates were lowered under Reagan and Bush. ”

Walker, I said as much in my comment. And the questions I posed is would that “pay a lot more in taxes” have occurred under the rising top tax rates that are being proposed today??

Putting money into the markets spurs economic activity. That economic activity creates wealth. That wealth is taxed.

“We taxed our way out of the Great Depression and World War II.”

What in the world are you talking about? You have to get this idea out of your head that the government is some kind of economic entity.

Dave said that Bill Gates said, “In terms of the very rich … Warren Buffett and I are the two wealthiest Americans — are certainly believing that the rich should be taxed a lot more…and the rich should give away more wealth than they currently do”

Hey Bill – no one is stopping you from giving away more. Have at it.

But, Bill, you aren’t king-of-the-world. I will decide whether or not I need to give away more, not you.

Paul, you truly believe that the government is NOT some kind of economic entity? What is your explanation of the business boom of the 1950s? (And don’t forget to include Eisenhower’s Interstate Highway system.)

Walker, it simply is not. That is not my belief it is a fact.

“What is your explanation of the business boom of the 1950s?”

Pent up consumer demand following the second world war caused the post war boom. The government didn’t create that? Are you suggesting that it had something to do with taxation?

Walker, don’t get me wrong. I am not saying that the government has no purpose it just doesn’t create economic activity like you seem to be suggesting.

Are you going to suggest that the Interstate Highway System had nothing to do with taxation? And do you really think that it had nothing to do with the business boom? Where did those folks with “pent up demand” find the money to buy anything? And you think our industry came out of World War II looking just like it did going in? Where did all that new capacity come from? What paid for it?

Goodness Walker that was a great reply.

“Bill, you aren’t king-of-the-world. I will decide whether or not I need to give away more, not you.”

Actually JDM… WE, we collectively, get to decide how much you… and how much Bill… and how much all of us, give away in taxes.

dave:

“Actually JDM… WE, we collectively, get to decide how much you… and how much Bill… and how much all of us, give away in taxes.”

and we, collectively will vote.

My voice is just as important as Bill Gates. We each get one vote.

“and we, collectively will vote.

My voice is just as important as Bill Gates. We each get one vote.”

Exactly. That was my point. We each get a say in this.

You and Bill… you each get a say in it. So why would you suggest that he was trying to be “King of the world” for doing exactly what you are doing… expressing an opinion on the matter?

heehee.

So you’re saying that Bill Gates just went from king-of-the-world, to one-man, one-vote, right?

You may quote me.

Paul a true philanthropist would give money to a private institution while they were still alive. Actually a large inheritance tax would spur giving as there would be no reason to wait. Its a great way to tax.

But anyway I think this is fascinating and a point that maybe should get a little more national play. If you look at red states, they don’t have a bunch of wealthy people, in general they are on the bottom economically, so this may be a trend. If the Democrats can get over the cultural divide they may make real inroads on this point.

Paul, you have my attention. S00000, what is an “economic entity”?

First, Brian, great post! Ask the In Box (http://blogs.northcountrypublicradio.org/inbox/2011/12/06/morning-read-gov-cuomo-embraces-a-tax-the-rich-plan/) and you shall receive. Real analysis we locals can actually use!

Paul, Bill Gates was born rich, actually. His dad was a wealthy lawyer, who went to law school on the GI Bill and later wrote a book advocating huge estate taxes, because he thought it was only fair. Apple (see what I just did there?) didn’t fall far from the tree, at least on the issue of fairness.

Finally, Mervel’s right, big-money giving would go up with a high Paris Hilton tax.

I think what we are dealing with here are misconceptions. Many believe or at least want to believe the rich are selfish while the poor and middle class are generous. But the fact of the matter is that people are people. Some are selfish no matter how much or how little money they have and some are generous no matter how little or how much money they have.

It’s not a money thing. It’s a character thing.

“Where did those folks with “pent up demand” find the money to buy anything?”

It came from the capital markets. The only place where money can come from.

Walker, consumer demand and consumer spending fuels the economy. Once more folks get a handle on that that will be able to make decisions that will have a positive impact on the economy. The current administration (and others) don’t appear to understand that.

I am not offering any solutions. This is just part of the explanation for why we are not seeing more economic activity. This is why companies and individuals are sitting on their money. They don’t know what is going to happen in the near term. Things are starting to loosen up a little. That could be stopped pretty fast if the government decides that it has to start meddling with the economy some more.

Walker, I am not sure what kind of big government spending idea you are thinking about but it will not work in the type of economy we now have. It is not 1950 anymore.

Ahhhh, I’ll try one more time, Paul. That is an “economic entity”?

oops Not “That” rather; What is an “economic entity”?

“consumer demand and consumer spending fuels the economy.”

And, when there is no demand, someone has to make up for it. Repairing and building infrastructure makes sense. At least more sense than removing even more demand and jobs by spending cuts.

Paul says: “consumer demand and consumer spending fuels the economy.”

Well, yeah. And that’s what spending on infrastructure (like the Interstates) does– it puts money into the hands of workers and turns them into consumers.

Paul says: “big government spending … will not work in the type of economy we now have.

Would you care to try and make that more than an empty claim?

Look Paul, I know you must think that John Maynard Keynes didn’t have a clue, but just ask yourself what would happen if we took a trillion dollars and spent it on repairing and building roads and bridges. Where would that trillion go? Who would it benefit?

Right now, companies are sitting on several trillion dollars of cash. Some of them have even started using it to buy back their own stock (not coincidentally triggering CEO bonuses and fattening up the CEO’s holdings).

Now if there was a whole lot more money in the hands of consumers, they’d be out buying stuff, and the companies would need those hoards of cash to hire people to make stuff to replace the stuff people were buying. And that would put even more money into the hands of consumers.

This is MUCH more effective that simply cutting a few percentage points off of rich folk’s taxes.

Now which scenario looks like a better deal for the economy?

Far too many of those with the money these days lack the imagination and character to actually DO anything with their money. We are wallowing in “investors” just waiting to make a buck, but we’re desperately short of vision and drive.

Give it all to the poor…at least they’ll spend it.

Keynes, had a clue. And you are misrepresenting what he theorized if you think that he would necessarily advocate for some kind of huge direct spending program like you describe.

Keynes argued (correctly) that the government should play a significant role through things like monetary policy and central bank policy, which it does. To suggest that he would have supported any kind of increase in deficit spending like you suggest is probably wrong.

People who support large government spending programs often incorrectly point to Keynes.

Walker, I think your mistake is that you think that it is access to capital drives demand. Demand is driven by demand.

Take it from the rich and give it to the poor is the “Robin Hoodyian” theory not the Keynesian theory.

Paul says: “your mistake is that you think that it is access to capital drives demand. Demand is driven by demand.”

No, Paul, SPENDING is driven by demand, if and only if there is capital behind it.

In the 1930s, Keynes spearheaded a revolution in economic thinking, overturning the older ideas of neoclassical economics that held that free markets would in the short to medium term automatically provide full employment, as long as workers were flexible in their wage demands.

Keynes instead argued that aggregate demand determined the overall level of economic activity, and that inadequate aggregate demand could lead to prolonged periods of high unemployment. Following the outbreak of World War II, Keynes’s ideas concerning economic policy were adopted by leading Western economies. During the 1950s and 1960s, the success of Keynesian economics resulted in almost all capitalist governments adopting its policy recommendations, promoting the cause of social liberalism.

http://en.wikipedia.org/wiki/John_Maynard_Keynes

Paul, don’t be dishonest. You know perfectly well that I am not advocating “Take it from the rich and give it to the poor.”

I AM advocating taxing corporations and the wealthy and spending it productively (especially as business is failing to spend its cash productively).

Back to that Wikipedia article:

“Keynes is widely considered to be one of the founders of modern macroeconomics, and to be the most influential economist of the 20th century.

In 1999, Time magazine included Keynes in their list of the 100 most important and influential people of the 20th century, commenting that: “His radical idea that governments should spend money they don’t have may have saved capitalism.”

And again…

“Keynes was deeply critical of the British government’s austerity measures during the Great Depression. He believed that budget deficits were a good thing, a product of recessions. He wrote, “For Government borrowing of one kind or another is nature’s remedy, so to speak, for preventing business losses from being, in so severe a slump as to present one, so great as to bring production altogether to a standstill.”

At the height of the Great Depression, in 1933, Keynes published The Means to Prosperity, which contained specific policy recommendations for tackling unemployment in a global recession, chiefly counter cyclical public spending. The Means to Prosperity contains one of the first mentions of the MULTIPLIER EFFECT. While it was addressed chiefly to the British Government, it also contained advice for other nations affected by the global recession. A copy was sent to the newly elected President Roosevelt and other world leaders.” (emphasis added)

Demand can be driven by different things. But “Demand is driven by demand” please explain. Along with waht an “economic entity” is

Walker, thanks for all the info. Next time just provide us with a link.