Why did NY Republicans sell out the state’s millionaires? They’re not from around here.

Last week’s landmark income tax reform deal locked in higher tax rates for high-wage New Yorkers and the deal was embraced by many Republican leaders who are generally low-tax advocates.

Last week’s landmark income tax reform deal locked in higher tax rates for high-wage New Yorkers and the deal was embraced by many Republican leaders who are generally low-tax advocates.

Nassau County state Senator Dean Skelos — who leads the GOP majority — shrugged off concerns about locking in higher tax rates for the wealthy, pointing out that the deal included a tax cut for the middle class.

That view was echoed by state Senator Betty Little from Queensbury, the Republican who represents much of the North Country.

The decision by Republicans to side with Democratic Governor Andrew Cuomo on a tax increase has drawn fire from some conservatives, but here’s one political reason the move might make sense politically:

Republican districts just don’t boast that many millionaires.

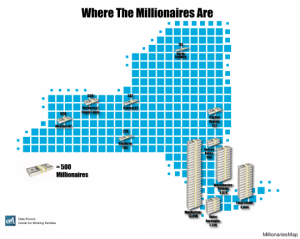

According to a probe of tax returns (which you can see in full here) conducted by a labor group at the City University of New York,83% of the state’s citizens who earn a million dollars a year or more live in Manhattan, on Long Island, or in Westchester and Putnam Counties.

Nearly half of the state’s million-dollar-a-year club lives in Manhattan alone.

Those regions have emerged as largely Democratic strongholds, though Putnam County is now represented by a Republican lawmakers.

By comparison, only .05% of the state’s wealthiest earners live here in the North Country, 111 of them in total according to 2008 returns. Fewer than 2% of North Country residents even earn $200,000 a year.

So while the GOP may have an ideological lean away from higher taxes, the fact is that few of their constituents will be affected adversely by this tax deal.

This dynamic may also be reflected in the Republican push to shift far more state government costs — particularly for costly Medicaid programs — onto income tax payers and away from property tax payers.

If successful, that effort would almost certainly mean even higher income taxes, and it would likely mean even more North Country programs being paid for by taxpayers downstate.

From the oft used Wikipedia:

“Although The General Theory was written during the Great Depression and was taken by many to justify the assumption by government of the responsibility for the achievement and maintenance of full employment, it is for the most part a highly abstract work of theory and by no means a tract on policy. Its full meaning and significance continues to be debated even today.”

As I said above people who bring up Keynes in support of a large government infusion of cash into a slowly growing economy are way out on thin branch.

But thanks for the debate.

Walker, I will admit that (even as an MBA) I have never fully read The General Theory of Employment Interest and Money. As a holiday assignment I will read it cover to cover and see if I can get where you are coming from.

You’re welcome, Paul. I didn’t want you to miss any of the good stuff.

To paraphrase Upton Sinclair, “It is difficult to get a man to understand something when his finances depend upon his not understanding it.”

And Paul, while you may not have read Keynes in depth, I’d be willing to bet that each of the gentlemen mentioned in the following quote have read him. So unless your last name happens to be Krugman, I’m afraid I am unlikely to be persuaded by your reading of Keynes.

“In the [March 2008] macroeconomist James K. Galbraith used the 25th Annual Milton Friedman Distinguished Lecture to launch a sweeping attack against the consensus for monetarist economics and argued that Keynesian economics were far more relevant for tackling the emerging crises. Economist Robert Shiller had begun advocating robust government intervention to tackle the financial crises, specifically citing Keynes. Nobel laureate Paul Krugman also actively argued the case for vigorous Keynesian intervention in the economy in his columns for the New York Times. Other prominent economic commentators arguing for Keynesian government intervention to mitigate the financial crisis include George Akerlof, Brad Delong, Robert Reich, and Joseph Stiglitz.” (ibid, of course)

Walker, obviously your mind is made up. But wait, like I said, I have not read it yet so you don’t know what “my reading will be”.

Have you read this yourself? Or are you just going with the Wiki version?

I’m just going with the Wikipedia version. (I don’t try to be my own doctor or lawyer, either.) And I read a lot of Paul Krugman.

And it makes sense to me. You can sell anything to people who have no money. And regular folks who lose a job soon have no money, so they cut back on buying stuff. If people aren’t buying, you can’t afford to hire more people to make more stuff that people aren’t buying. There is no straightforward way out of this gridlock, short of government spending to prime the pump. See the 1970s; stagflation; Voodoo, er, Reaganomics; trickle-down economics, etc.

“Economist John Kenneth Galbraith noted that supply side economics was not a new theory. He wrote, ‘Mr. David Stockman has said that supply-side economics was merely a cover for the trickle-down approach to economic policy—what an older and less elegant generation called the horse-and-sparrow theory: If you feed the horse enough oats, some will pass through to the road for the sparrows.'” (http://en.wikipedia.org/wiki/Supply_side_economics )

Oops! That second paragraph should start “And it makes sense to me. You CAN’T sell anything…”

Paul, a serious question: Is Keynesian theory taught, or at least taught much, in an MBA program?

oa, I think Paul would tell you no. That the majority of time is spent talking about “economic entities” and “demand fueling demand”

I too am confused with the statement “demand is driven by demand”.

PNElba, sorry for the confusion. Like I said above my point was that you cannot simply create demand by giving out money.

I spent a little time looking over Keynes and he seems like more of a fiscal hawk. A very strong focus on a responsible monetary policy and a strong central bank. We have both of those. I think that he might suggest that we spend money to “stimulate” the economy IF we had a surplus. But do you think he would suggest that we spend money we don’t have and drive ourselves deeper into the hole in the process. But that is just my take. Like Walker says Krugman does think that this is a problem that we should throw more taxpayer money at and he does think that Keynes would agree with him.

“Paul, a serious question: Is Keynesian theory taught, or at least taught much, in an MBA program?”

Not where I was. You can study economic theory if you want. I did not.

compare

with the direct quote of keynes provided by walker above:

i don’t think paul’s take on keynes is holding up so well.

i’m not an economist either, but from the smart economists i read (krugman, delong), that’s just plain wrong. giving out money would most certainly create demand.

Well, ht, to play devil’s advocate, theoretically, money doesn’t create demand. If you had a population that was perfectly satisfied with what they possessed (this is a hypothetical for sure!), then if you handed out money, it would go unspent. Of course, real world, putting additional money into the hands of people who have wants and needs (virtually every last person on the planet) will allow those wants and needs to be expressed, creating demand.